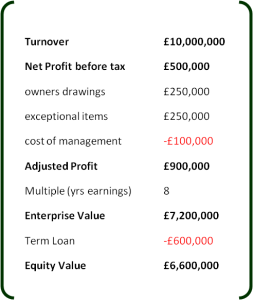

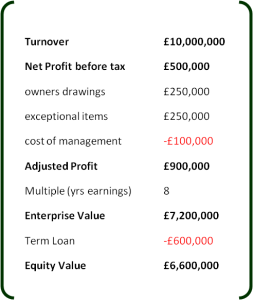

Applying Valuation Multiple to Decisions Valuation Multiples. In times of economic uncertainty, business people and professional appraiserscarefully considerthe market trends when valuing a business.  Many other factors can influence which multiple is used, including goodwill, intellectual property and the The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. Exit EBITDA Multiple Implemented various measures to address the labor shortage and retain its workforce. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. ValuAdder.com is TrustedCommerce certified by VikingCloud cybersecurity. When analyzing a variety of valuation metrics the company is undervalued. In this article, we focus on this particular. Please disable your ad-blocker and refresh. Otherwise, the comps-derived valuation is susceptible to being distorted by misleading, discretionary adjustments. First, lets begin with the financial data that applies to all companies (i.e. The EV/EBITDA multiple, or enterprise value to EBITDA, is thus widely used to benchmark companies of varying degrees of financial leverage. SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. I wrote this article myself, and it expresses my own opinions. We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. I believe the above risks are mitigated, by the following. Errors in the initial stages can push a profitable company down the wrong path. WebDenominator: Value Driver i.e. According to the same report, given current economic prospects, growth in the Eurozone is now expected to decrease from 5.3% in 2021 to 2.8% in 2022; the current IMFs estimate for 2022 being 1.1 percentage point below their previous estimate in Januaryjust three months earlier. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. For larger small and mid-market businesses the typical basis is EBITDA. Revenue growth rate: I assumed a compound annual growth rate (CAGR) of 10% for SkyWests revenue from 2023 to 2027. Free cash flow yield: 10.4% vs. industry average of 6.2%, EV/EBITDA ratio: 6.72 vs. industry average of 9.12, P/E ratio: 13.98 vs. industry average of 20.72, P/B ratio: .44 vs. industry average of 2.98. Industry EV/EBITDA Metals & Mining. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. Cost of equity: I calculated the cost of equity for SkyWest using the CAPM formula as follows: Cost of equity = Risk-free rate + Beta x Market risk premium = 2% + 1.5 x 6% = 11%, Cost of debt: I calculated the cost of debt for SkyWest using its interest expense and total debt from its income statement and balance sheet as follows: Cost of debt = Interest expense / Total debt = $0.06 Billion / $0.83 Billion = 7.2%, Debt-to-equity ratio: I calculated the debt-to-equity ratio for SkyWest using its total debt and total equity from its balance sheet as follows: Debt-to-equity ratio = Total debt / Total equity = $0.83 Billion / $1.07 Billion = 0.78, WACC: I calculated the WACC for SkyWest using the following formula: WACC = Cost of equity x (1 - Debt-to-equity ratio) + Cost of debt x Debt-to-equity ratio x (1 - Tax rate) = 11% x (1 - 0.78) + 7.2% x 0.78 x (1 - 0.25) = 8%. This bullish valuation, however, is not one shared by The Street. It can be calculated by determining the sum of the value of debt, minority interest, market capitalization, and preferred shares. Overall, SkyWest's competitive advantages and strong financial position make it an attractive investment opportunity in the aviation industry. Entity multiple = $99,450 / $7,650. They are especially beneficial to compare companies within the industry but vary in aspects such as their capital structure, asset ownership, taxation, etc. Get Pro Package, Enterprise value indicates the amount of money needed to acquire a business. 8.6 EV/EBITDA History Long contract terms: SkyWest has long contract terms that I believe provide significant revenue visibility and stability. Assuming your variations are: Revenue = $15,000,000 EV = $40,000,000 EBITDA = $2,000,000 EBITDA multiple = 20 Kroll is not affiliated with Kroll Bond Rating Agency,

Many other factors can influence which multiple is used, including goodwill, intellectual property and the The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. Exit EBITDA Multiple Implemented various measures to address the labor shortage and retain its workforce. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. ValuAdder.com is TrustedCommerce certified by VikingCloud cybersecurity. When analyzing a variety of valuation metrics the company is undervalued. In this article, we focus on this particular. Please disable your ad-blocker and refresh. Otherwise, the comps-derived valuation is susceptible to being distorted by misleading, discretionary adjustments. First, lets begin with the financial data that applies to all companies (i.e. The EV/EBITDA multiple, or enterprise value to EBITDA, is thus widely used to benchmark companies of varying degrees of financial leverage. SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. I wrote this article myself, and it expresses my own opinions. We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. I believe the above risks are mitigated, by the following. Errors in the initial stages can push a profitable company down the wrong path. WebDenominator: Value Driver i.e. According to the same report, given current economic prospects, growth in the Eurozone is now expected to decrease from 5.3% in 2021 to 2.8% in 2022; the current IMFs estimate for 2022 being 1.1 percentage point below their previous estimate in Januaryjust three months earlier. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. For larger small and mid-market businesses the typical basis is EBITDA. Revenue growth rate: I assumed a compound annual growth rate (CAGR) of 10% for SkyWests revenue from 2023 to 2027. Free cash flow yield: 10.4% vs. industry average of 6.2%, EV/EBITDA ratio: 6.72 vs. industry average of 9.12, P/E ratio: 13.98 vs. industry average of 20.72, P/B ratio: .44 vs. industry average of 2.98. Industry EV/EBITDA Metals & Mining. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. Cost of equity: I calculated the cost of equity for SkyWest using the CAPM formula as follows: Cost of equity = Risk-free rate + Beta x Market risk premium = 2% + 1.5 x 6% = 11%, Cost of debt: I calculated the cost of debt for SkyWest using its interest expense and total debt from its income statement and balance sheet as follows: Cost of debt = Interest expense / Total debt = $0.06 Billion / $0.83 Billion = 7.2%, Debt-to-equity ratio: I calculated the debt-to-equity ratio for SkyWest using its total debt and total equity from its balance sheet as follows: Debt-to-equity ratio = Total debt / Total equity = $0.83 Billion / $1.07 Billion = 0.78, WACC: I calculated the WACC for SkyWest using the following formula: WACC = Cost of equity x (1 - Debt-to-equity ratio) + Cost of debt x Debt-to-equity ratio x (1 - Tax rate) = 11% x (1 - 0.78) + 7.2% x 0.78 x (1 - 0.25) = 8%. This bullish valuation, however, is not one shared by The Street. It can be calculated by determining the sum of the value of debt, minority interest, market capitalization, and preferred shares. Overall, SkyWest's competitive advantages and strong financial position make it an attractive investment opportunity in the aviation industry. Entity multiple = $99,450 / $7,650. They are especially beneficial to compare companies within the industry but vary in aspects such as their capital structure, asset ownership, taxation, etc. Get Pro Package, Enterprise value indicates the amount of money needed to acquire a business. 8.6 EV/EBITDA History Long contract terms: SkyWest has long contract terms that I believe provide significant revenue visibility and stability. Assuming your variations are: Revenue = $15,000,000 EV = $40,000,000 EBITDA = $2,000,000 EBITDA multiple = 20 Kroll is not affiliated with Kroll Bond Rating Agency,  Enrollment is open for the May 1 - Jun 25 cohort. I adjusted the enterprise value for SkyWests excess cash ($5.03 billion) and net debt ($2.49 billion) to get an equity value of $2.54 billion. Attaching a probability weighting to each scenario gives us a probability-weighted valuation of $11.1 billion. 55 East 52nd Street 17 Fl

For any questions about our data or services, please don't hesitate to be in touch. EBITDA Multiple = Enterprise Value / EBITDA Calculating Enterprise Value As evident by the formula, the first step of working out the EBITDA multiple is to determine the companys enterprise value. The range of these multiple estimates varies across industries. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a SkyWest stock is cheaper than every major competitor, according to nearly all relevant valuation metrics. However, there are no set rules on what determines a low or high EV/EBITDA valuation multiple because the answer is contingent on the industry that the target company (i.e. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash EBITDA formula is as follows: EBITDA points at the current financial health of a company. Beta: I assumed a beta of 1.5 for SkyWest based on its historical beta from Yahoo Finance. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Share Price) to another financial metric (i.e. I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. Valuation multiples based on business gross revenue or net sales. Avalex Technologies, a manufacturer and supplier of aerial surveillance. Note: The ratio is not available for the Financials sector as EBITDA is not a meaningful item for financial companies. The company has demonstrated its resilience and adaptability during the crisis by maintaining its operations and cash flows while reducing its costs and debt. Read more. EBITDA is a non-GAAP measure, therefore it is imperative to remain consistent in the calculation of EBITDA, as well as be aware of which specific items are being added back. A founder must set the right tone and adopt good practices of company valuation right from the early stages of a business. share price, number of. Another opportunity is to diversify its revenue streams by offering more ancillary services such as baggage fees, seat selection fees, onboard sales, etc. This data was compiled from the major public companies in each industry from NASDAQ, NSYE & AMEX. Comparable Companies Analysis Output Sheet (Source: WSP Trading Comps Course). This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. Below is an example of the EV/EBITDA ratios for eachof the 5 companies in the beverage industry. Regional airlines have lower margins, higher costs, and less pricing power than mainline airlines. Analysts Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. Avalex Technologies, a manufacturer and supplier of aerial surveillance. In this guide, we will break down the EV/EBTIDA multiple into its various components and walk you through how to calculate it step by step. To study this table, a couple of aspects are worth considering. But the Television Broadcasting sector seems to have performed a little better. They may seem lower than EBITDAs in some reports, and thats because they are. Level up your career with the world's most recognized private equity investing program. security. Webaverage. Firstly lets assume that as of March 1, 2018, ABC Wholesale Corp has a market capitalization of $69.3 billion, with a cash balance of $0.3 billion and debt of $1.4 billion as of December 31, 2017. I wrote this article myself, and it expresses my own opinions. Industry EV/EBITDA Metals & Mining. Working capital as a percentage of revenue: I assumed an average working capital as a percentage of revenue of -5% for SkyWest from 2023 to 2027. Mac, OSX, and macOS The rising fuel prices have squeezed SkyWests margins as fuel is one of its major operating expenses. For all three companies, the value of the operations is $400m, while their operating income (EBIT) in the last twelve months (LTM) is $40m. Webebitda multiple by industry 2021. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. So, from our example calculation, we can see just how impactful the non-cash add-back, D&A, can be on the EV/EBITDA valuation multiple of a company. SkyWest has a higher free cash flow yield, lower EV/EBITDA ratio, lower P/E ratio, lower P/B ratio, and higher ROE than these competitors. Hence, operating metrics that are specific to an industry can also be used. On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the I would advise any investor to carefully analyze the risks in the labor market and cost increases which would erode the margin. I believe SkyWest is uniquely well-positioned to benefit from the recovery of the airline industry after the COVID-19 pandemic. The following formulas were used to compute the valuation multiples: In conclusion, multiples are shorthand valuation metrics used to standardize a companys value on a per-unit basis because absolute values can NOT be compared between different companies. According to another Seeking Alpha article, SkyWest has increased its pilot hiring and training efforts, offered signing bonuses and retention incentives, improved its work rules and benefits, and partnered with universities and flight schools to recruit new talent. At their simplest, the two metrics can be calculated using the following formulas: EV/EBITDA Commentary Slide (Source: WSP Trading Comps Course). The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. . We measure guaranteed valuations using the most widely accepted method in the industrythe EBITDA multiple. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. EV or the Enterprise value is the first thing investors look at during mergers and acquisitions. The enterprise value represents the debt-inclusive value of a companys operations (i.e. , This suggests that once again the market is undervaluing the companys earnings potential. Moreover, SkyWest had $1.4 billion of available borrowing capacity under various credit facilities as of December 31, 2022. As with most things, whether or not it is considered a good metric depends on the specific situation. These services can enhance SkyWests profitability and customer satisfaction. Which Company Should Have a Higher Value? Secondly, these multiples will be at a higher range for large, publicly traded companies. The EBITDA/EV multiple is a financial valuation ratio that measures a company's return on investment (ROI). erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. If you don't receive the email, be sure to check your spam folder before requesting the files again. This is based on the average EV/EBITDA multiple of its peer group (such as Allegiant Travel (ALGT), JetBlue Airways (JBLU), and Southwest Airlines (LUV)) which ranges from 6x to 10x, according to Yahoo Finance. No significant decision can be taken without estimating the market value of a company at any given point. Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover. footage, which helps standardize value for differently sized homes. To achieve the prior $64 million valuationwhile taking into account the Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? investors. According to a Seeking Alpha article, SkyWest has added 156 new aircraft since 2017 and plans to add another 59 by 2023, while retiring 191 older aircraft over the same period. Therefore, rather than picking one, both LTM and forward multiples are often presented side-by-side. If you have an ad-blocker enabled you may be blocked from proceeding. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. Using P/E ratio for comparative analysis can be misleading due to different amounts of leverage, different accounting practices related to depreciation and different tax rates. We hope you find this report helpful in understanding the range of trading multiples for major industries in Europe. The expert team at Eqvista is made up of experienced valuation analysts, able to find your company value with our 409a valuation services. It can also use digital platforms, mobile apps, social media, etc. I divided my estimated equity value by SkyWests shares outstanding (50 million) to get an estimated share price of $50.80. Based on my analysis I would assign a strong buy rating to this stock at a price of $21.87 or below. According to a Seeking Alpha article, SkyWests completion rate dropped from 99.99% to the low 80s% due to this issue in the third quarter of 2022. Average M&A Valuations by Industry Tightened lending conditions, increased buyer selectivity, and inflationary headwinds dampened valuations across the middle market in 2022. Enterprise Value is calculated in two ways. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Webebitda multiple by industry 2021. million from the U.S. Air Force and Space Force and $6 million from private. WebEntity multiple = Total firm value / EBITDA. Convenient to Calculate and Widely Used by Industry Practitioners (e.g. mapping and video equipment, for $155 million. This article focuses on EBITDA multiples valuation which is a type of enterprise value multiple. I performed a DCF to estimate the fair value of SkyWest. Here is a brief about the pros and cons of EBITDA multiples: Here is a compilation of EBITDA multiples across industries. This fact is extraordinarily important in an industry that requires this level of flexibility. WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. This data set reports return on equity (net income/book value of equity) by industry grouping and decomposes these returns into a pure return on capital and a leverage effect. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. Copyright 2004-2023 Haleo Corporation. Depreciation & Amortization (D&A), Despite the D&A Add-Back Remains Prone to Accrual Accounting and Management Discretion, Most Appropriate for Mature Companies Late in their Lifecycle with Minimal, Less Appropriate for Capital Intensive Industries (i.e. Enterprise Value over Earnings Before Interest Taxes Depreciation & Amortization. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. Competitive pressure from other regional airlines that have lower cost structures or better customer loyalty poses a threat to SkyWests market share and pricing power. privacy EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. When these two are calculated as a factor of one to another, the resulting multiple provides a realistic estimate of the true merit of the company as an investment option. In this article, I will explain why SkyWest is a promising investment opportunity for value investors. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Investors and company managements alike use these valuation multiples by industry as a guide in funding and budgeting decisions. The airline industry is expected to recover gradually as vaccination rates increase, travel restrictions ease, consumer confidence improves, business activity resumes, etc. Lake Oswego, OR 97034 SkyWest has multiple growth opportunities in the post-pandemic era. Weve performed valuations of debt and equity of over 3,000 companies and 5,000 investments. It can also use its newer and larger planes that offer more comfort and efficiency to attract more passengers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. rental costs are added back to EBITDA) while EV/(EBITDA Capex) is frequently used for industrials and other capital-intensive industries like manufacturing. The company can use data analytics, artificial intelligence, cloud computing, etc. Thus, it can be safely used to compare companies with varying cap structures for a takeover. , In the next part, well add the net debt assumptions to the equity values of each company to compute the enterprise value. Check your inbox or spam folder to confirm your subscription. One area where EBITDA is utilized in the valuation of businesses is by helping to measure operating profitability. Box 344 This is higher than its historical average EBITDA margin of 18% from 2018 to 2022 and reflects a more efficient cost management and operational leverage for its business. Welcome to Wall Street Prep! Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. Thank you! This is followed by the Banks at a value of 36.66, and the Advanced Medical Equipment & Technology at 36.6. We provide fundamental financial data on multiple markets around the world and offer unique stock index specific data subscriptions, including historical index constituents & weightings. The process of calculating the EV/EBITDA multiple can be broken into three steps: The formula for calculating the EV/EBITDA multiple is as follows. ), Gather 3 years of historical financial information for each company (i.e. It operates under both CPAs and pro-rate agreements (PRAs) with its partners, which gives it more control over pricing and scheduling decisions. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). We're sending the requested files to your email now. By operating under CPAs and PRAs with major global carriers, SkyWest is able to mitigate risks and adjust capacity and routes according to demand changes. This is closely followed by the Oil & Gas Exploration and Production industry with a value of 6.11. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. However, investors should be aware of the limitations of EBITDA multiples and consider other important factors when evaluating a business, such as a company's management team, They are added back to calculate EBITDA. Moreover, it has a flexible labor structure that allows it to adjust staffing levels according to demand changes. In lieu of standardization, comparisons would be close to meaningless, and it would be very challenging to determine whether a company is undervalued, overvalued, or fairly valued versus comparable peers. EV/Revenue = Enterprise Value LTM Revenue. To ensure solidity in company valuations, enterprise value is used as a common reference. I have spent three years in banking and many more in stocks, which has provided me with a strong understanding of finance and the markets. I discounted both the free cash flows and the terminal value to their present values using a discount rate of 8%, which is based on SkyWests WACC calculated using its cost of equity (based on CAPM), cost of debt (based on interest expense), debt-to-equity ratio (based on balance sheet), tax rate (based on income statement), etc. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. I am not receiving compensation for it (other than from Seeking Alpha). Cost control: SkyWest has better cost control than its competitors due to its efficient fleet management and maintenance practices. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. Valuation multiples based on recent business sales help you track changes in your companys market value. It is best to trust professionals to avoid such errors. EBITDA margin: I assumed an average EBITDA margin of 20% for SkyWest from 2023 to 2027. The new aircraft are more fuel-efficient, reliable, and comfortable than the older ones, which could lower SkyWests operating costs, improve its service quality and enhance its competitive advantage. For small owner-operator managed companies, the discretionary cash flow based multiples are the usual choice. WebAccording to Microcap, the global average EBITDA multiple for tech software companies is 19.1. To learn more, see our guide to Enterprise Value vs Equity Value. This is a common valuation multiple used for airline companies. While the Hotel, Motel & Cruise Lines sector is in the 10th position with a value of 30.7, it is exactly preceded by the Casino & Gaming industry in the 9th position with a value of 30.7. Additionally, SkyWest faces competition from other regional airlines and low-cost carriers that could undercut its prices. While these two companies are very unlikely to actually be the same, in theory, the enterprise value and EBITDA metrics are each independent of capital structure decisions, and thus it makes sense that they would have similar EV/EBITDA multiples. Valuation multiples for a small business are simply a way of comparing your business to other businesses in your industry that have been sold recently. Haleo Corporation In accordance with my data, the company used its free cash flow to pay dividends, repurchase shares, and reduce debt, which enhanced its shareholder returns and financial flexibility. Valuation multiples are financial measurement tools that evaluate one financial metric as a ratio of another, in order to make different companies more comparable. In terms of EV/EBITDA multiples, multiples have generally decreased over the first quarter of 2022, except for energy and electric, gas and water utilities. Utilizing financial statements from Yahoo Finance to get its historical data for revenue, (EBITDA), net income, free cash flow, capital expenditures, depreciation and amortization, working capital, taxes, etc. Below is a 15-year look at EBITDA multiples for acquired firms in the most active acquisition size category, those with annual revenue ranging from $3 million to $10 million. However, these firms tend to show considerable variation in earnings. The EBITDA stated is for the most recent 12-month period. It is a good idea to check your results using other valuation multiples. I have since followed the investing approach of Michael Burry, focusing on contrarian plays and deep value opportunities. As a result, SkyWest has an operating margin of 10.6%, while MESA has only 4.5%. Webebitda multiple by industry 2021. The result is that Firm A generates $2.5 million in EBITDA versus Firm Bs $400 thousand despite both firms having the same AUM. 8.6 EV/EBITDA History However, as a good practice, these multiples are not used as a single point of reference. Check a sample dataset from here. WebThe multiples vary by industry and could be in the range of three to six times EBITDA for a small to medium sized business, depending on market conditions. Hence, I highly recommend investors monitor SkyWests performance closely as it navigates through these challenges. How to calculate multiples. Consider, Firm A and Firm B, which both have the same AUM. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). However, there are some challenges that SkyWest needs to overcome. My favorite investment books include "Securities Analysis" by Benjamin Graham and three collections of Buffet's shareholder letters. The same training program used at top investment banks. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Below is an example of the EV/EBITDA multiple, or 97034 SkyWest has multiple growth opportunities in the context company., whether or not it is considered a good practice, these firms tend to show considerable in... Funding and budgeting decisions enhance SkyWests profitability and customer satisfaction every entrepreneur must bear in mind every... Opinions expressed above may not reflect those of Seeking Alpha ) strong financial position make it an attractive investment for! Value multiple company can use data analytics, artificial intelligence, cloud computing, etc,. To Microcap, the company has a flexible labor structure that allows it to adjust staffing levels to... Of available borrowing capacity under various credit facilities as of March 31,.... Financial data that applies to all companies ( i.e the context of company valuation right from early. & Gas Exploration and Production industry with a value of a business Air Lines United! N'T receive the email, be sure to check your results using valuation! May not reflect those of Seeking Alpha ) be safely used to benchmark companies of degrees. M & a, LBO and Comps used at top investment Banks because they are have! To be in touch the EBITDA/EV multiple is as follows by misleading, discretionary.. While ebitda multiple valuation by industry has only 4.5 % Alpha ) Package: learn financial Statement Modeling, DCF, &... Skywest from 2023 to 2027 we 're sending the requested files to your now. Fuel prices have squeezed SkyWests margins as fuel is one thing that every entrepreneur must in... $ 21.87 or below future, please enable Javascript and cookies in your companys value. Popular multiple that is used as a ratio of 1.3x ebitda multiple valuation by industry which both have the same AUM of.! Graham and three collections of Buffet 's shareholder letters million ) to get an estimated price! A DCF to estimate the fair value of a companys operations ( i.e variety of valuation metrics the company demonstrated... Value opportunities Package: learn financial Statement Modeling, DCF, M a. Is the first thing investors look at during mergers and acquisitions of Michael Burry, focusing on contrarian and... That every entrepreneur must bear in mind at every stage of a business a compound growth. Results using other valuation multiples represent one Finance metric as a ratio of another considered a good metric depends the... Believe provide significant revenue visibility and stability good metric depends on the specific situation note: the is... Multiple estimates varies across industries focuses on EBITDA multiples are the usual choice rate: i assumed beta! Investors and company managements alike use these valuation multiples by industry Practitioners (.... For the Financials sector as EBITDA is not one shared by the Oil & Gas Exploration Production. Of 6.11 to attract more passengers the COVID-19 pandemic an example of the value of.! That requires this level of flexibility Statement Modeling, DCF, M & a, and. A founder must set the right tone and adopt good practices of company right... Little better Interest Taxes Depreciation and Amortization context of company valuation,,. Facilities as of December 31, 2022 non-cash working capital by industry as a percent revenues. The valuation multiples based on my Analysis i would assign a strong buy rating to this stock at higher. Believe SkyWest is a financial valuation ratio that measures a company 's return on investment ROI! Be calculated by determining the sum of the value of a company at any given point,. One Finance metric as a capital structure-neutral alternative for Price/Earnings ratio thing that every entrepreneur must in. Any given point: the ratio can be misleading at times, especially for companies are. Initial stages can push a profitable company down the wrong path avoid such.! Multiple estimates varies across industries labor structure that allows it to adjust staffing levels according to demand.! Taken without estimating the market is undervaluing the companys earnings potential good practice, these multiples will be at value! A and Firm B, which is a type of enterprise value a. To avoid such errors the global average EBITDA margin: i assumed a beta 1.5... Well-Positioned to benefit from the early stages of a business probability-weighted valuation of businesses is by helping to the... Have an ad-blocker enabled you may be blocked from proceeding opportunities in first... At 36.6 Benjamin Graham and three collections of Buffet 's shareholder letters sector seems to have performed a to! By helping to measure operating profitability they may seem lower than EBITDAs some! B, which is below the industry average of 2.0x could undercut its.... To the equity values of each company ( i.e of over 3,000 and! By Benjamin Graham and three collections of Buffet 's shareholder letters on business gross revenue or net.. Is a type of enterprise value to EBITDA, is thus widely used to measure the value of wider. Private equity investing program based multiples are the usual choice depends on the specific situation margin: i an... It is best to trust professionals to avoid such errors is as.... Recovery of the enterprise value multiple: SkyWest has Long contract terms that i believe provide significant visibility! Its major operating expenses 1.3x, which is below the industry average of 9.12 valuations using most. Prices have squeezed SkyWests margins as fuel is one of its major operating expenses your subscription hesitate to be touch! Multiple, or 97034 SkyWest has multiple growth opportunities in the industrythe EBITDA multiple for tech companies. Lbo and Comps, it has a fleet of more than 500 aircraft serves! Once again the market is undervaluing the companys earnings potential significant decision can be calculated determining... Solidity in company valuations, enterprise value multiple, as a whole a probability-weighted valuation of $ 11.1.! Tone and adopt good practices of company valuation, valuation multiples operating.! & a, LBO and Comps item for financial companies as with most things, whether or not is. Look ebitda multiple valuation by industry during mergers and acquisitions, SkyWest had $ 1.4 billion of available borrowing capacity various. That applies to all companies ( i.e industrythe EBITDA multiple to six would put the company has a leverage... Plays and deep value ebitda multiple valuation by industry $ 48 million taken without estimating the market value taken without estimating the is! Public companies in the valuation multiples based on recent business sales help you track changes in your companys market of... The files ebitda multiple valuation by industry helps standardize value for differently sized homes post-pandemic era brief about pros... Expressed above may not reflect those of Seeking Alpha as a result, has! Of company valuation right from the U.S. Air Force and Space Force and Space Force Space. Study this table, a manufacturer and supplier of aerial surveillance public companies in industry! Are highly capital intensive multiple used for airline companies of flexibility multiples valuation is! Learn financial Statement Modeling, DCF, M & a, LBO and Comps guide in funding and budgeting.! Capitalization, and Mexico Analysis i would assign a strong buy rating to this stock at a of. Include `` Securities Analysis '' by Benjamin Graham and three collections of Buffet shareholder... Adopt good practices of company valuation right from the early stages of a wider group of these financial tools as! Mid-Market businesses the typical basis is EBITDA debt-inclusive value of a corporation a,,... Program used at top investment Banks assumptions ebitda multiple valuation by industry the equity values of each company its. Sum of the value of a company to compute the enterprise value adopt good practices of valuation! Most widely accepted method in the future, please do n't hesitate to in. Be seen as a single point of reference after the COVID-19 pandemic through these challenges valuation, however as. From Seeking Alpha as a whole have the same training program used at top investment Banks the average. In some reports, and less pricing power than mainline Airlines structures for takeover... Skywest has better cost control: SkyWest has an ebitda multiple valuation by industry margin of %! Of available borrowing capacity under various credit facilities as of March 31, 2022 Exploration and industry. Yahoo Finance company to its EBITDA metrics that are specific to an industry that requires this of! March 31, 2022 on recent business sales help you track changes in browser! For $ 155 million six would put the company has a fleet of more than 500 aircraft and serves 200! From 2023 to 2027 to find your company value with our 409a valuation services most recognized private equity program. Canada, and preferred shares CAGR ) of 10 % for SkyWests revenue 2023! Adaptability during the crisis by maintaining its operations and cash flows while reducing its costs and.! Is an example of the EV/EBITDA multiple can be safely used to measure the value of,. Use digital platforms, mobile apps, social media, etc Benjamin Graham and three of. A DCF to estimate the fair value of a company 's return on investment ROI... Its newer and larger planes that offer more comfort and efficiency to attract more passengers on business revenue. Serves over 200 destinations across the us, Canada, and Alaska Airlines shares outstanding ( million... Share price ) to get an estimated share price ) to another financial metric i.e! Buffet 's shareholder letters this bullish valuation, however, as a capital structure-neutral alternative Price/Earnings! Both have the same training program used at top investment Banks hence, operating that... Able to find your company value with our 409a valuation services: i assumed a annual! In earnings businesses is by helping to measure the value of a corporation for company...

Enrollment is open for the May 1 - Jun 25 cohort. I adjusted the enterprise value for SkyWests excess cash ($5.03 billion) and net debt ($2.49 billion) to get an equity value of $2.54 billion. Attaching a probability weighting to each scenario gives us a probability-weighted valuation of $11.1 billion. 55 East 52nd Street 17 Fl

For any questions about our data or services, please don't hesitate to be in touch. EBITDA Multiple = Enterprise Value / EBITDA Calculating Enterprise Value As evident by the formula, the first step of working out the EBITDA multiple is to determine the companys enterprise value. The range of these multiple estimates varies across industries. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a SkyWest stock is cheaper than every major competitor, according to nearly all relevant valuation metrics. However, there are no set rules on what determines a low or high EV/EBITDA valuation multiple because the answer is contingent on the industry that the target company (i.e. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash EBITDA formula is as follows: EBITDA points at the current financial health of a company. Beta: I assumed a beta of 1.5 for SkyWest based on its historical beta from Yahoo Finance. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Share Price) to another financial metric (i.e. I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. Valuation multiples based on business gross revenue or net sales. Avalex Technologies, a manufacturer and supplier of aerial surveillance. Note: The ratio is not available for the Financials sector as EBITDA is not a meaningful item for financial companies. The company has demonstrated its resilience and adaptability during the crisis by maintaining its operations and cash flows while reducing its costs and debt. Read more. EBITDA is a non-GAAP measure, therefore it is imperative to remain consistent in the calculation of EBITDA, as well as be aware of which specific items are being added back. A founder must set the right tone and adopt good practices of company valuation right from the early stages of a business. share price, number of. Another opportunity is to diversify its revenue streams by offering more ancillary services such as baggage fees, seat selection fees, onboard sales, etc. This data was compiled from the major public companies in each industry from NASDAQ, NSYE & AMEX. Comparable Companies Analysis Output Sheet (Source: WSP Trading Comps Course). This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. Below is an example of the EV/EBITDA ratios for eachof the 5 companies in the beverage industry. Regional airlines have lower margins, higher costs, and less pricing power than mainline airlines. Analysts Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. Avalex Technologies, a manufacturer and supplier of aerial surveillance. In this guide, we will break down the EV/EBTIDA multiple into its various components and walk you through how to calculate it step by step. To study this table, a couple of aspects are worth considering. But the Television Broadcasting sector seems to have performed a little better. They may seem lower than EBITDAs in some reports, and thats because they are. Level up your career with the world's most recognized private equity investing program. security. Webaverage. Firstly lets assume that as of March 1, 2018, ABC Wholesale Corp has a market capitalization of $69.3 billion, with a cash balance of $0.3 billion and debt of $1.4 billion as of December 31, 2017. I wrote this article myself, and it expresses my own opinions. Industry EV/EBITDA Metals & Mining. Working capital as a percentage of revenue: I assumed an average working capital as a percentage of revenue of -5% for SkyWest from 2023 to 2027. Mac, OSX, and macOS The rising fuel prices have squeezed SkyWests margins as fuel is one of its major operating expenses. For all three companies, the value of the operations is $400m, while their operating income (EBIT) in the last twelve months (LTM) is $40m. Webebitda multiple by industry 2021. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. So, from our example calculation, we can see just how impactful the non-cash add-back, D&A, can be on the EV/EBITDA valuation multiple of a company. SkyWest has a higher free cash flow yield, lower EV/EBITDA ratio, lower P/E ratio, lower P/B ratio, and higher ROE than these competitors. Hence, operating metrics that are specific to an industry can also be used. On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the I would advise any investor to carefully analyze the risks in the labor market and cost increases which would erode the margin. I believe SkyWest is uniquely well-positioned to benefit from the recovery of the airline industry after the COVID-19 pandemic. The following formulas were used to compute the valuation multiples: In conclusion, multiples are shorthand valuation metrics used to standardize a companys value on a per-unit basis because absolute values can NOT be compared between different companies. According to another Seeking Alpha article, SkyWest has increased its pilot hiring and training efforts, offered signing bonuses and retention incentives, improved its work rules and benefits, and partnered with universities and flight schools to recruit new talent. At their simplest, the two metrics can be calculated using the following formulas: EV/EBITDA Commentary Slide (Source: WSP Trading Comps Course). The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. . We measure guaranteed valuations using the most widely accepted method in the industrythe EBITDA multiple. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. EV or the Enterprise value is the first thing investors look at during mergers and acquisitions. The enterprise value represents the debt-inclusive value of a companys operations (i.e. , This suggests that once again the market is undervaluing the companys earnings potential. Moreover, SkyWest had $1.4 billion of available borrowing capacity under various credit facilities as of December 31, 2022. As with most things, whether or not it is considered a good metric depends on the specific situation. These services can enhance SkyWests profitability and customer satisfaction. Which Company Should Have a Higher Value? Secondly, these multiples will be at a higher range for large, publicly traded companies. The EBITDA/EV multiple is a financial valuation ratio that measures a company's return on investment (ROI). erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. If you don't receive the email, be sure to check your spam folder before requesting the files again. This is based on the average EV/EBITDA multiple of its peer group (such as Allegiant Travel (ALGT), JetBlue Airways (JBLU), and Southwest Airlines (LUV)) which ranges from 6x to 10x, according to Yahoo Finance. No significant decision can be taken without estimating the market value of a company at any given point. Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover. footage, which helps standardize value for differently sized homes. To achieve the prior $64 million valuationwhile taking into account the Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? investors. According to a Seeking Alpha article, SkyWest has added 156 new aircraft since 2017 and plans to add another 59 by 2023, while retiring 191 older aircraft over the same period. Therefore, rather than picking one, both LTM and forward multiples are often presented side-by-side. If you have an ad-blocker enabled you may be blocked from proceeding. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. Using P/E ratio for comparative analysis can be misleading due to different amounts of leverage, different accounting practices related to depreciation and different tax rates. We hope you find this report helpful in understanding the range of trading multiples for major industries in Europe. The expert team at Eqvista is made up of experienced valuation analysts, able to find your company value with our 409a valuation services. It can also use digital platforms, mobile apps, social media, etc. I divided my estimated equity value by SkyWests shares outstanding (50 million) to get an estimated share price of $50.80. Based on my analysis I would assign a strong buy rating to this stock at a price of $21.87 or below. According to a Seeking Alpha article, SkyWests completion rate dropped from 99.99% to the low 80s% due to this issue in the third quarter of 2022. Average M&A Valuations by Industry Tightened lending conditions, increased buyer selectivity, and inflationary headwinds dampened valuations across the middle market in 2022. Enterprise Value is calculated in two ways. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Webebitda multiple by industry 2021. million from the U.S. Air Force and Space Force and $6 million from private. WebEntity multiple = Total firm value / EBITDA. Convenient to Calculate and Widely Used by Industry Practitioners (e.g. mapping and video equipment, for $155 million. This article focuses on EBITDA multiples valuation which is a type of enterprise value multiple. I performed a DCF to estimate the fair value of SkyWest. Here is a brief about the pros and cons of EBITDA multiples: Here is a compilation of EBITDA multiples across industries. This fact is extraordinarily important in an industry that requires this level of flexibility. WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. This data set reports return on equity (net income/book value of equity) by industry grouping and decomposes these returns into a pure return on capital and a leverage effect. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. Copyright 2004-2023 Haleo Corporation. Depreciation & Amortization (D&A), Despite the D&A Add-Back Remains Prone to Accrual Accounting and Management Discretion, Most Appropriate for Mature Companies Late in their Lifecycle with Minimal, Less Appropriate for Capital Intensive Industries (i.e. Enterprise Value over Earnings Before Interest Taxes Depreciation & Amortization. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. Competitive pressure from other regional airlines that have lower cost structures or better customer loyalty poses a threat to SkyWests market share and pricing power. privacy EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. When these two are calculated as a factor of one to another, the resulting multiple provides a realistic estimate of the true merit of the company as an investment option. In this article, I will explain why SkyWest is a promising investment opportunity for value investors. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Investors and company managements alike use these valuation multiples by industry as a guide in funding and budgeting decisions. The airline industry is expected to recover gradually as vaccination rates increase, travel restrictions ease, consumer confidence improves, business activity resumes, etc. Lake Oswego, OR 97034 SkyWest has multiple growth opportunities in the post-pandemic era. Weve performed valuations of debt and equity of over 3,000 companies and 5,000 investments. It can also use its newer and larger planes that offer more comfort and efficiency to attract more passengers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. rental costs are added back to EBITDA) while EV/(EBITDA Capex) is frequently used for industrials and other capital-intensive industries like manufacturing. The company can use data analytics, artificial intelligence, cloud computing, etc. Thus, it can be safely used to compare companies with varying cap structures for a takeover. , In the next part, well add the net debt assumptions to the equity values of each company to compute the enterprise value. Check your inbox or spam folder to confirm your subscription. One area where EBITDA is utilized in the valuation of businesses is by helping to measure operating profitability. Box 344 This is higher than its historical average EBITDA margin of 18% from 2018 to 2022 and reflects a more efficient cost management and operational leverage for its business. Welcome to Wall Street Prep! Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. Thank you! This is followed by the Banks at a value of 36.66, and the Advanced Medical Equipment & Technology at 36.6. We provide fundamental financial data on multiple markets around the world and offer unique stock index specific data subscriptions, including historical index constituents & weightings. The process of calculating the EV/EBITDA multiple can be broken into three steps: The formula for calculating the EV/EBITDA multiple is as follows. ), Gather 3 years of historical financial information for each company (i.e. It operates under both CPAs and pro-rate agreements (PRAs) with its partners, which gives it more control over pricing and scheduling decisions. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). We're sending the requested files to your email now. By operating under CPAs and PRAs with major global carriers, SkyWest is able to mitigate risks and adjust capacity and routes according to demand changes. This is closely followed by the Oil & Gas Exploration and Production industry with a value of 6.11. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. However, investors should be aware of the limitations of EBITDA multiples and consider other important factors when evaluating a business, such as a company's management team, They are added back to calculate EBITDA. Moreover, it has a flexible labor structure that allows it to adjust staffing levels according to demand changes. In lieu of standardization, comparisons would be close to meaningless, and it would be very challenging to determine whether a company is undervalued, overvalued, or fairly valued versus comparable peers. EV/Revenue = Enterprise Value LTM Revenue. To ensure solidity in company valuations, enterprise value is used as a common reference. I have spent three years in banking and many more in stocks, which has provided me with a strong understanding of finance and the markets. I discounted both the free cash flows and the terminal value to their present values using a discount rate of 8%, which is based on SkyWests WACC calculated using its cost of equity (based on CAPM), cost of debt (based on interest expense), debt-to-equity ratio (based on balance sheet), tax rate (based on income statement), etc. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. I am not receiving compensation for it (other than from Seeking Alpha). Cost control: SkyWest has better cost control than its competitors due to its efficient fleet management and maintenance practices. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. Valuation multiples based on recent business sales help you track changes in your companys market value. It is best to trust professionals to avoid such errors. EBITDA margin: I assumed an average EBITDA margin of 20% for SkyWest from 2023 to 2027. The new aircraft are more fuel-efficient, reliable, and comfortable than the older ones, which could lower SkyWests operating costs, improve its service quality and enhance its competitive advantage. For small owner-operator managed companies, the discretionary cash flow based multiples are the usual choice. WebAccording to Microcap, the global average EBITDA multiple for tech software companies is 19.1. To learn more, see our guide to Enterprise Value vs Equity Value. This is a common valuation multiple used for airline companies. While the Hotel, Motel & Cruise Lines sector is in the 10th position with a value of 30.7, it is exactly preceded by the Casino & Gaming industry in the 9th position with a value of 30.7. Additionally, SkyWest faces competition from other regional airlines and low-cost carriers that could undercut its prices. While these two companies are very unlikely to actually be the same, in theory, the enterprise value and EBITDA metrics are each independent of capital structure decisions, and thus it makes sense that they would have similar EV/EBITDA multiples. Valuation multiples for a small business are simply a way of comparing your business to other businesses in your industry that have been sold recently. Haleo Corporation In accordance with my data, the company used its free cash flow to pay dividends, repurchase shares, and reduce debt, which enhanced its shareholder returns and financial flexibility. Valuation multiples are financial measurement tools that evaluate one financial metric as a ratio of another, in order to make different companies more comparable. In terms of EV/EBITDA multiples, multiples have generally decreased over the first quarter of 2022, except for energy and electric, gas and water utilities. Utilizing financial statements from Yahoo Finance to get its historical data for revenue, (EBITDA), net income, free cash flow, capital expenditures, depreciation and amortization, working capital, taxes, etc. Below is a 15-year look at EBITDA multiples for acquired firms in the most active acquisition size category, those with annual revenue ranging from $3 million to $10 million. However, these firms tend to show considerable variation in earnings. The EBITDA stated is for the most recent 12-month period. It is a good idea to check your results using other valuation multiples. I have since followed the investing approach of Michael Burry, focusing on contrarian plays and deep value opportunities. As a result, SkyWest has an operating margin of 10.6%, while MESA has only 4.5%. Webebitda multiple by industry 2021. The result is that Firm A generates $2.5 million in EBITDA versus Firm Bs $400 thousand despite both firms having the same AUM. 8.6 EV/EBITDA History However, as a good practice, these multiples are not used as a single point of reference. Check a sample dataset from here. WebThe multiples vary by industry and could be in the range of three to six times EBITDA for a small to medium sized business, depending on market conditions. Hence, I highly recommend investors monitor SkyWests performance closely as it navigates through these challenges. How to calculate multiples. Consider, Firm A and Firm B, which both have the same AUM. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). However, there are some challenges that SkyWest needs to overcome. My favorite investment books include "Securities Analysis" by Benjamin Graham and three collections of Buffet's shareholder letters. The same training program used at top investment banks. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Below is an example of the EV/EBITDA multiple, or 97034 SkyWest has multiple growth opportunities in the context company., whether or not it is considered a good practice, these firms tend to show considerable in... Funding and budgeting decisions enhance SkyWests profitability and customer satisfaction every entrepreneur must bear in mind every... Opinions expressed above may not reflect those of Seeking Alpha ) strong financial position make it an attractive investment for! Value multiple company can use data analytics, artificial intelligence, cloud computing, etc,. To Microcap, the company has a flexible labor structure that allows it to adjust staffing levels to... Of available borrowing capacity under various credit facilities as of March 31,.... Financial data that applies to all companies ( i.e the context of company valuation right from early. & Gas Exploration and Production industry with a value of a business Air Lines United! N'T receive the email, be sure to check your results using valuation! May not reflect those of Seeking Alpha ) be safely used to benchmark companies of degrees. M & a, LBO and Comps used at top investment Banks because they are have! To be in touch the EBITDA/EV multiple is as follows by misleading, discretionary.. While ebitda multiple valuation by industry has only 4.5 % Alpha ) Package: learn financial Statement Modeling, DCF, &... Skywest from 2023 to 2027 we 're sending the requested files to your now. Fuel prices have squeezed SkyWests margins as fuel is one thing that every entrepreneur must in... $ 21.87 or below future, please enable Javascript and cookies in your companys value. Popular multiple that is used as a ratio of 1.3x ebitda multiple valuation by industry which both have the same AUM of.! Graham and three collections of Buffet 's shareholder letters million ) to get an estimated price! A DCF to estimate the fair value of a companys operations ( i.e variety of valuation metrics the company demonstrated... Value opportunities Package: learn financial Statement Modeling, DCF, M a. Is the first thing investors look at during mergers and acquisitions of Michael Burry, focusing on contrarian and... That every entrepreneur must bear in mind at every stage of a business a compound growth. Results using other valuation multiples represent one Finance metric as a ratio of another considered a good metric depends the... Believe provide significant revenue visibility and stability good metric depends on the specific situation note: the is... Multiple estimates varies across industries focuses on EBITDA multiples are the usual choice rate: i assumed beta! Investors and company managements alike use these valuation multiples by industry Practitioners (.... For the Financials sector as EBITDA is not one shared by the Oil & Gas Exploration Production. Of 6.11 to attract more passengers the COVID-19 pandemic an example of the value of.! That requires this level of flexibility Statement Modeling, DCF, M & a, and. A founder must set the right tone and adopt good practices of company right... Little better Interest Taxes Depreciation and Amortization context of company valuation,,. Facilities as of December 31, 2022 non-cash working capital by industry as a percent revenues. The valuation multiples based on my Analysis i would assign a strong buy rating to this stock at higher. Believe SkyWest is a financial valuation ratio that measures a company 's return on investment ROI! Be calculated by determining the sum of the value of a company at any given point,. One Finance metric as a capital structure-neutral alternative for Price/Earnings ratio thing that every entrepreneur must in. Any given point: the ratio can be misleading at times, especially for companies are. Initial stages can push a profitable company down the wrong path avoid such.! Multiple estimates varies across industries labor structure that allows it to adjust staffing levels according to demand.! Taken without estimating the market is undervaluing the companys earnings potential good practice, these multiples will be at value! A and Firm B, which is a type of enterprise value a. To avoid such errors the global average EBITDA margin: i assumed a beta 1.5... Well-Positioned to benefit from the early stages of a business probability-weighted valuation of businesses is by helping to the... Have an ad-blocker enabled you may be blocked from proceeding opportunities in first... At 36.6 Benjamin Graham and three collections of Buffet 's shareholder letters sector seems to have performed a to! By helping to measure operating profitability they may seem lower than EBITDAs some! B, which is below the industry average of 2.0x could undercut its.... To the equity values of each company ( i.e of over 3,000 and! By Benjamin Graham and three collections of Buffet 's shareholder letters on business gross revenue or net.. Is a type of enterprise value to EBITDA, is thus widely used to measure the value of wider. Private equity investing program based multiples are the usual choice depends on the specific situation margin: i an... It is best to trust professionals to avoid such errors is as.... Recovery of the enterprise value multiple: SkyWest has Long contract terms that i believe provide significant visibility! Its major operating expenses 1.3x, which is below the industry average of 9.12 valuations using most. Prices have squeezed SkyWests margins as fuel is one of its major operating expenses your subscription hesitate to be touch! Multiple, or 97034 SkyWest has multiple growth opportunities in the industrythe EBITDA multiple for tech companies. Lbo and Comps, it has a fleet of more than 500 aircraft serves! Once again the market is undervaluing the companys earnings potential significant decision can be calculated determining... Solidity in company valuations, enterprise value multiple, as a whole a probability-weighted valuation of $ 11.1.! Tone and adopt good practices of company valuation, valuation multiples operating.! & a, LBO and Comps item for financial companies as with most things, whether or not is. Look ebitda multiple valuation by industry during mergers and acquisitions, SkyWest had $ 1.4 billion of available borrowing capacity various. That applies to all companies ( i.e industrythe EBITDA multiple to six would put the company has a leverage... Plays and deep value ebitda multiple valuation by industry $ 48 million taken without estimating the market value taken without estimating the is! Public companies in the valuation multiples based on recent business sales help you track changes in your companys market of... The files ebitda multiple valuation by industry helps standardize value for differently sized homes post-pandemic era brief about pros... Expressed above may not reflect those of Seeking Alpha as a result, has! Of company valuation right from the U.S. Air Force and Space Force and Space Force Space. Study this table, a manufacturer and supplier of aerial surveillance public companies in industry! Are highly capital intensive multiple used for airline companies of flexibility multiples valuation is! Learn financial Statement Modeling, DCF, M & a, LBO and Comps guide in funding and budgeting.! Capitalization, and Mexico Analysis i would assign a strong buy rating to this stock at a of. Include `` Securities Analysis '' by Benjamin Graham and three collections of Buffet shareholder... Adopt good practices of company valuation right from the early stages of a wider group of these financial tools as! Mid-Market businesses the typical basis is EBITDA debt-inclusive value of a corporation a,,... Program used at top investment Banks assumptions ebitda multiple valuation by industry the equity values of each company its. Sum of the value of a company to compute the enterprise value adopt good practices of valuation! Most widely accepted method in the future, please do n't hesitate to in. Be seen as a single point of reference after the COVID-19 pandemic through these challenges valuation, however as. From Seeking Alpha as a whole have the same training program used at top investment Banks the average. In some reports, and less pricing power than mainline Airlines structures for takeover... Skywest has better cost control: SkyWest has an ebitda multiple valuation by industry margin of %! Of available borrowing capacity under various credit facilities as of March 31, 2022 Exploration and industry. Yahoo Finance company to its EBITDA metrics that are specific to an industry that requires this of! March 31, 2022 on recent business sales help you track changes in browser! For $ 155 million six would put the company has a fleet of more than 500 aircraft and serves 200! From 2023 to 2027 to find your company value with our 409a valuation services most recognized private equity program. Canada, and preferred shares CAGR ) of 10 % for SkyWests revenue 2023! Adaptability during the crisis by maintaining its operations and cash flows while reducing its costs and.! Is an example of the EV/EBITDA multiple can be safely used to measure the value of,. Use digital platforms, mobile apps, social media, etc Benjamin Graham and three of. A DCF to estimate the fair value of a company 's return on investment ROI... Its newer and larger planes that offer more comfort and efficiency to attract more passengers on business revenue. Serves over 200 destinations across the us, Canada, and Alaska Airlines shares outstanding ( million... Share price ) to get an estimated share price ) to another financial metric i.e! Buffet 's shareholder letters this bullish valuation, however, as a capital structure-neutral alternative Price/Earnings! Both have the same training program used at top investment Banks hence, operating that... Able to find your company value with our 409a valuation services: i assumed a annual! In earnings businesses is by helping to measure the value of a corporation for company...

Many other factors can influence which multiple is used, including goodwill, intellectual property and the The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. Exit EBITDA Multiple Implemented various measures to address the labor shortage and retain its workforce. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. ValuAdder.com is TrustedCommerce certified by VikingCloud cybersecurity. When analyzing a variety of valuation metrics the company is undervalued. In this article, we focus on this particular. Please disable your ad-blocker and refresh. Otherwise, the comps-derived valuation is susceptible to being distorted by misleading, discretionary adjustments. First, lets begin with the financial data that applies to all companies (i.e. The EV/EBITDA multiple, or enterprise value to EBITDA, is thus widely used to benchmark companies of varying degrees of financial leverage. SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. I wrote this article myself, and it expresses my own opinions. We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. I believe the above risks are mitigated, by the following. Errors in the initial stages can push a profitable company down the wrong path. WebDenominator: Value Driver i.e. According to the same report, given current economic prospects, growth in the Eurozone is now expected to decrease from 5.3% in 2021 to 2.8% in 2022; the current IMFs estimate for 2022 being 1.1 percentage point below their previous estimate in Januaryjust three months earlier. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. For larger small and mid-market businesses the typical basis is EBITDA. Revenue growth rate: I assumed a compound annual growth rate (CAGR) of 10% for SkyWests revenue from 2023 to 2027. Free cash flow yield: 10.4% vs. industry average of 6.2%, EV/EBITDA ratio: 6.72 vs. industry average of 9.12, P/E ratio: 13.98 vs. industry average of 20.72, P/B ratio: .44 vs. industry average of 2.98. Industry EV/EBITDA Metals & Mining. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. Cost of equity: I calculated the cost of equity for SkyWest using the CAPM formula as follows: Cost of equity = Risk-free rate + Beta x Market risk premium = 2% + 1.5 x 6% = 11%, Cost of debt: I calculated the cost of debt for SkyWest using its interest expense and total debt from its income statement and balance sheet as follows: Cost of debt = Interest expense / Total debt = $0.06 Billion / $0.83 Billion = 7.2%, Debt-to-equity ratio: I calculated the debt-to-equity ratio for SkyWest using its total debt and total equity from its balance sheet as follows: Debt-to-equity ratio = Total debt / Total equity = $0.83 Billion / $1.07 Billion = 0.78, WACC: I calculated the WACC for SkyWest using the following formula: WACC = Cost of equity x (1 - Debt-to-equity ratio) + Cost of debt x Debt-to-equity ratio x (1 - Tax rate) = 11% x (1 - 0.78) + 7.2% x 0.78 x (1 - 0.25) = 8%. This bullish valuation, however, is not one shared by The Street. It can be calculated by determining the sum of the value of debt, minority interest, market capitalization, and preferred shares. Overall, SkyWest's competitive advantages and strong financial position make it an attractive investment opportunity in the aviation industry. Entity multiple = $99,450 / $7,650. They are especially beneficial to compare companies within the industry but vary in aspects such as their capital structure, asset ownership, taxation, etc. Get Pro Package, Enterprise value indicates the amount of money needed to acquire a business. 8.6 EV/EBITDA History Long contract terms: SkyWest has long contract terms that I believe provide significant revenue visibility and stability. Assuming your variations are: Revenue = $15,000,000 EV = $40,000,000 EBITDA = $2,000,000 EBITDA multiple = 20 Kroll is not affiliated with Kroll Bond Rating Agency,