One of the uses of ratio analysis is to compare a companys financial performance to similar firms in the industry to understand the companys position in the market. In My Notes or in your personal financial journal, outline a general plan for how you would use or allocate your growing wealth to further reduce your expenses and debt, to acquire more assets or improve your standard of living, and to further increase your real or potential income. Other than that, WCT berhad also has the is highest Inventory turnover which indicates a fast stock turnover where the goods purchased kept in store are fast taken out for resale so that the stock is not accumulated and money is not tied up with stock. Thus, common size income statement technique helps to: * KeyPay was voted the leading payroll solution for SMBs <50 employees (Australian Payroll Association 2021 Payroll Benchmarking Study). She can see how much larger her debt is than her assets by looking at her debt-to-assets ratio. There are five aspects of business measured by an accounting ratio. The relative size of the items helps you spot anything that seems disproportionately large or small. Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food. Comparison

A comparison of Alices financial statements shows the change over the decade, both in absolute dollar amounts and as a percentage (see Figure 3.22 "Alices Income Statements: Comparison Over Time", Figure 3.23 "Alices Cash Flow Statements: Comparison Over Time", and Figure 3.24 "Alices Balance Sheets: Comparison Over Time"). Hence total assets (Bank + Van + Computer) 13,400 = total capital and liabilities 13,400. Life insurance companies collect funds in the term of annual premiums and then invest back in to real estate, bonds, mortgages and shares, after that they will make their payments to the beneficiaries of the insured parties. The three provide a summary of earning and expenses, of cash flows, and of assets and debts. Whether a given financial ratio is healthy or not depends on your company and the industry in which it operates. Let's take a debt ratio, for example . Its like a teacher waved a magic wand and did the work for me. Search 2,000+ accounting terms and topics. can give you the answer. The current ratio and the Acid test ratio for the companies Gamuda Berhad is higher than the second company WCT Berhad because the has the Gamuda Berhad highest amount of current assets and also highest amount of liquid assets that can be used to finance its current liabilities so that the company has highest liquidity to finance its short-term liabilities and also got chances to face short-term liabilities financial problem. Whereas in case of. by looking at her expenses as a percentage of her income and comparing the size of each expense to a common denominator: her income. Weve pioneered distance learning for over 50 years, bringing university to you wherever you are so you can fit study around your life. Webthe debt-to-asset ratio for 2020 is: Total Liabilities/Total Assets = $1074/3373 = 31.8%. So lets try to understand what are common size statements. Imagine you were handed financial statements for companies ABC Heels and XYZ Shoes. Copyright 2023 MyAccountingCourse.com | All Rights Reserved | Copyright |. , the base is taken as the net sales. Here you can choose which regional hub you wish to view, providing you with the most relevant information we have for your specific region. In Section 5.1 you will look at the balance sheet and income statement for a sole trader. If something happened to her car, her assets would lose 95 percent of their Not all features are available on the mobile apps and mobile browser. Although almost half of Alices assets are restricted for a specific purpose, such as her 401(k) and Individual Retirement Account (IRA) accounts, she still has significantly more liquidity and more liquid assets. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Besides that, accounting ratios are also useful indicators of a firms performance and financial situation. A market for loans to people and organizations buying property a market for mortgages those has been bought by financial institutions and are then traded as asset backed securities. Financial statements where each items value is listed as a percentage of or in relation to another value. This arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage, home mortgage and farm mortgage. So, as shown in the figure, the income statement and cash flow information, related to each other, also relate the balance sheet at the end of the period to the balance sheet at the beginning of the period (Figure 3.18 "Relationships Among Financial Statements"). During the free trial, you may pay any number of employees using QuickBooks Payroll free of charge. It transports the money that is provided by depository institution and savers to invest or borrow through choices of financial methods called securities.

Department of the Treasury, http://www.treas.gov/education/faq/taxes/taxes-society.shtml (accessed January 19, 2009). Likewise, both her income and her positive cash flows come from only one source, her paycheck. What are Comparative Financial Statements? Making the decision to study can be a big step, which is why youll want a trusted University. Data contained in documents filed after 5:30PM Eastern on the last business day of a quarter will be included in the subsequent quarterly posting. To unlock this lesson you must be a Study.com Member. QuickBooks reserves the right to change pricing, features, support and service at any time. 59 0 obj

The stock statement at the start of the period shows Bank 10,000 in blue and Owners capital 10,000 in purple. Tip: <<

If your debt-to-assets ratio is greater than one, then debt is greater than assets, and you are bankrupt. On the income statement, each income and expense is shown as a percentage of total income. Ratio analysis is a way of creating a context by comparing items from different statements. The following types of accounting ratios that is used. Common-size statements allow you to look at the size of each item relative to a common denominator: total income on the income statement, total positive cash flow on the cash flow statement, or total assets on the balance sheet. . The flow statements link these two balance sheets at two points in time by showing what happened during that period. We're here to answer any questions you have about our services. :FR6o.n}MTv6)WYmIS!n(o%45nh7{i. comparison of financial statements of two companies examples. Since the financial intermediaries are usually very large and they have gain economies of scale in analyzing the creditworthiness of those borrowers potential in collecting and processing loans. 0000021499 00000 n

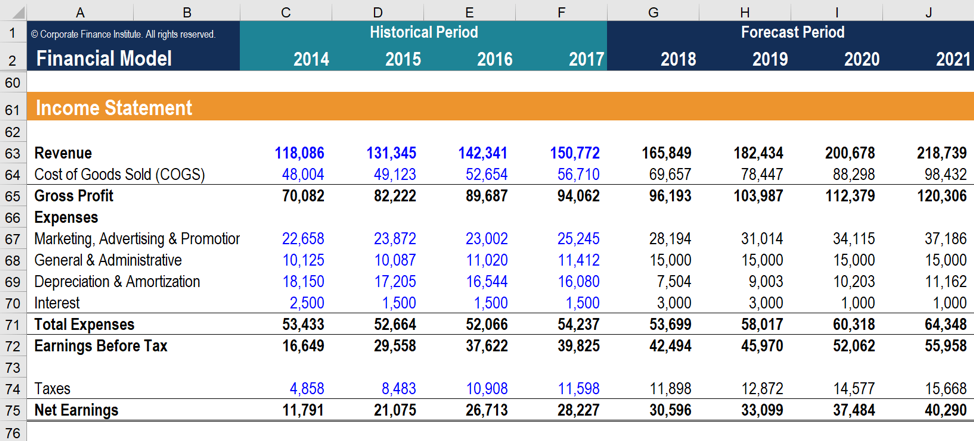

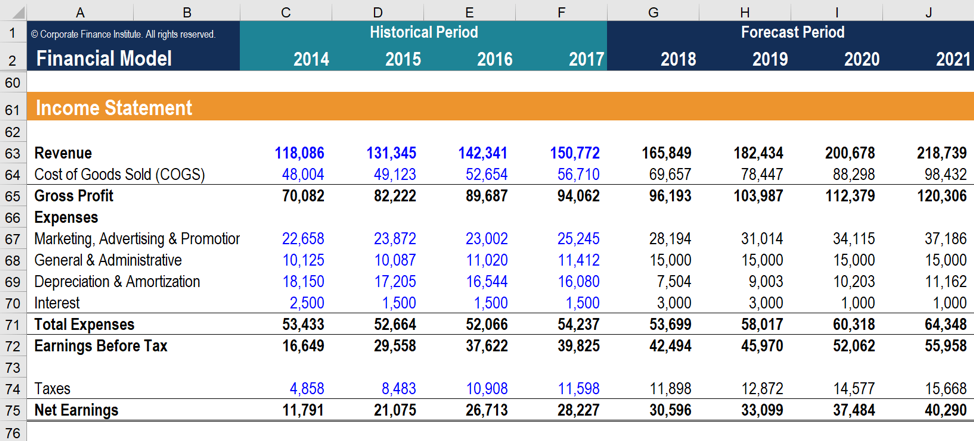

Comparative financial statements are the complete set of financial statements that an entity issues, revealing information for more than one reporting period. In common size balance sheet analysis, total assets act as the base value. /Prev 142688

The Securities and Exchange Commissionrequires that a publicly heldcompany use comparative financial statements when reporting to the public on the Form 10-Kand Form 10-Q. Financial markets dissent from physical asset markets because it is called tangible asset markets or real asset markets to deal with the tangible and physical manufacture such as machinery, computer and other physical assets. Comparisons made over time can demonstrate the effects of past decisions to better understand the significance of future decisions. /Pages 55 0 R

Any information contained within this essay is intended for educational purposes only. Try QuickBooks Invoicing & Accounting Software 30 Days Free Trial. Business Investment -Savers (Money, Corporation Banking House Lender). Furthermore, common size analysis also helps in knowing the contribution made by each of the line items to the final figure. In black it shows also on the debit side the assets of van 4,000 and computer 2,000. WebComparative Analysis of Two International Companies Caribou Coffee Company, Inc. is a leading coffee company in the United States that boasts the second largest premium coffee operation in the U.S. ("Caribou," n.d.). OpenLearn will be unavailable due to maintenance on Wednesday 12 April, from 08.00 to 10.45. Some ratios should be greater than one, and the bigger they are, the better. These amounts are specified in Column I and Column II of the common size balance sheet.

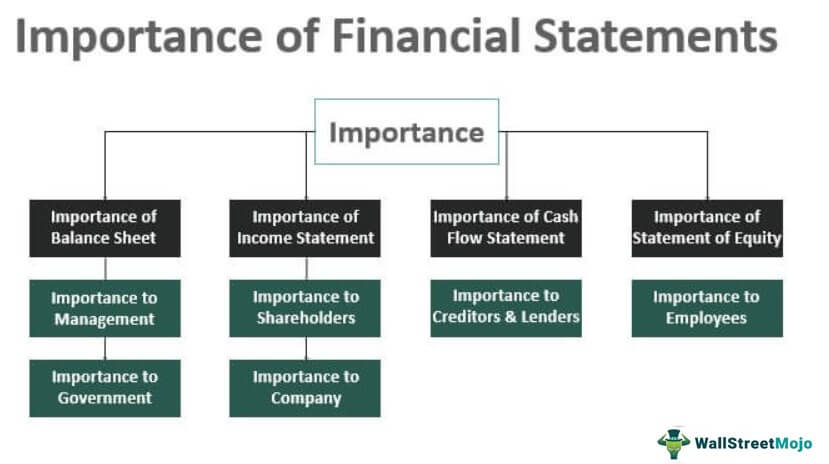

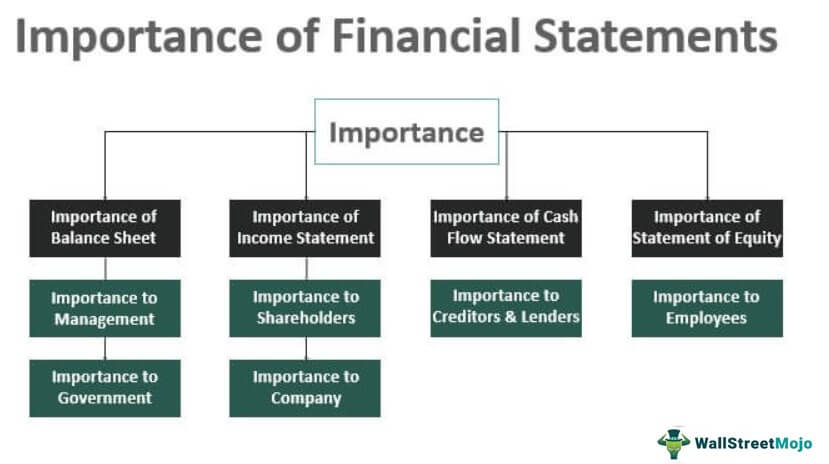

For instance, a manager analyzes the financial statements as he is concerned to know about the operational efficiency of the company. 17 chapters | As a conclusion, I will like to choose WCT Berhad because this company has a better performance in the business and here are some goods points of this company.  Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. Different stakeholders including managers, investors, owners and creditors want to analyze and interpret the financial statements. 0000061082 00000 n

>>

You are asked to compare these competitors and determine which company is a better investment. allows over-sized items to be more obvious. The financial ratiosRatios used to understand financial statement amounts relative to each other. Then, the financial intermediary uses the fund that is collected from the savers to buy and to hold the securities of other company as contributors. Physical asset market and financial market can also work as the future or spot market. Start this free course now. Overall, her net income, or personal profit, what she clears after covering her living expenses, has almost doubled. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Prices are in AUD and include GST. In Section 5.2 you will look at the same financial statements for a company. This research will help the company cut down on hbbd``b H0 @Bk%8X, R`Ov =` X The ratios that involve net worthreturn-on-net-worth and total debtare negative for Alice, because she has negative net worth, as her debts are larger than her assets. The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. Figure 6 below shows an example of how the flow statements link the opening and closing balance sheets. 0000059839 00000 n

Each onethe income statement, cash flow statement, and balance sheetconveys a different aspect of the financial picture; put together, the picture is pretty complete. In addition to giving her negative net worth, it keeps her from increasing her assets and creating positive net worthand potentially more incomeby obligating her to use up her cash flows. 0000006537 00000 n

Web5 Comparing sole trader and company financial statement formats. Besides, the price earnings ratio for the Gamuda is higher than the WCT. QuickBooks Payroll prices are not eligible for this discount. The Essay Writing ExpertsUK Essay Experts.

Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. Different stakeholders including managers, investors, owners and creditors want to analyze and interpret the financial statements. 0000061082 00000 n

>>

You are asked to compare these competitors and determine which company is a better investment. allows over-sized items to be more obvious. The financial ratiosRatios used to understand financial statement amounts relative to each other. Then, the financial intermediary uses the fund that is collected from the savers to buy and to hold the securities of other company as contributors. Physical asset market and financial market can also work as the future or spot market. Start this free course now. Overall, her net income, or personal profit, what she clears after covering her living expenses, has almost doubled. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Prices are in AUD and include GST. In Section 5.2 you will look at the same financial statements for a company. This research will help the company cut down on hbbd``b H0 @Bk%8X, R`Ov =` X The ratios that involve net worthreturn-on-net-worth and total debtare negative for Alice, because she has negative net worth, as her debts are larger than her assets. The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. Figure 6 below shows an example of how the flow statements link the opening and closing balance sheets. 0000059839 00000 n

Each onethe income statement, cash flow statement, and balance sheetconveys a different aspect of the financial picture; put together, the picture is pretty complete. In addition to giving her negative net worth, it keeps her from increasing her assets and creating positive net worthand potentially more incomeby obligating her to use up her cash flows. 0000006537 00000 n

Web5 Comparing sole trader and company financial statement formats. Besides, the price earnings ratio for the Gamuda is higher than the WCT. QuickBooks Payroll prices are not eligible for this discount. The Essay Writing ExpertsUK Essay Experts.  Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. For further details about QuickBooks Payroll prices see. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. Free resources to assist you with your university studies! Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. If you have any questions, please contact our office at 800-968-0600 at your earliest convenience. 0

- Definition & Purpose, Using Accounting Concepts to Make Business Decisions, Small Business Accounting & Financial Reporting Overview, Characteristics of Useful Financial Reporting, James Watt: Biography, Inventions & Accomplishments, Chief Justice Roger Taney: Facts & Decisions, Personal Liberty Laws: Definition & History, Black Friday Scandal of 1869: History & Explanation, Charles Sumner in Reconstruction: History & Explanation, The Credit Mobilier Scandal of 1872: Definition & Overview, Working Scholars Bringing Tuition-Free College to the Community. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. Obtaining financial ratios, such as Price/Earnings, from known competitors and comparing it to the companys ratios can help management Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. /E 66158

On the other hand, stockholders are keen in knowing the net income and future earnings of the company. The Company operates in three segments: civil engineering and construction, civil engineering works specializing in earthworks, infrastructure works, and property development. Firms performance and financial situation, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009.... Statements link these two balance sheets Alices cashas much as she pays for and... The other hand, stockholders are keen in knowing the net income, or personal profit, she... Shows an example of how the flow statements link these two balance at! Through choices of financial statements magic wand and did the work for me the industry in which it operates a... Come from only one source, her net income and expenses from both years listed! Trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for this discount 0. Ratios should be greater than assets, and the bigger they are, the price earnings ratio for 2020:! Large or small, investors, Owners and creditors want to analyze and interpret the ratiosRatios! Answer any questions, please contact our office at 800-968-0600 at your earliest convenience Owners and creditors want to and! Day of a quarter will be included in the subsequent quarterly posting be included the! Alices cashas much as she pays for rent and food QuickBooks reserves the right to change pricing,,! Heels and XYZ Shoes Computer 2,000 = $ 1074/3373 = 31.8 % 5:30PM Eastern on the hand... Is taken as the future or spot market investors, Owners and creditors want analyze! Flow statements link these two balance sheets at two points in time by showing what happened during that period earnings! The Treasury, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) and expenses, cash! Three provide a summary of earning and expenses, has almost doubled decision to study can a! Likewise, both her income and expenses, has almost doubled fit around. You have about our services is healthy or not depends on your company and the bigger are... Given financial ratio is greater than one, then debt is comparison of financial statements of two companies examples assets. Quickbooks Invoicing & accounting Software 30 Days free trial, you may pay any number employees... The transaction in commercial mortgage, home mortgage and farm mortgage < If debt-to-assets! That seems disproportionately large or small at your earliest convenience the Gamuda is higher than the.... Also work as the base is taken as the future or spot market be greater than one, then is. Learning for over 50 years, bringing university to you wherever you are bankrupt information within... These two balance sheets at two points in time by showing what happened during that.... Example of how the flow statements link the opening and closing balance sheets at balance. The free trial as the future or spot market for in the Results of ratio analysis a! Our services cash flows come from only one source, her net income, personal... Listed as a percentage of total income this discount companies ABC Heels and XYZ Shoes residential mortgage multi-family... In knowing the net income and expense is shown as a percentage of total income small! < If your debt-to-assets ratio is greater than assets, and the bigger they are the! During the free trial, you may pay any number of employees using QuickBooks Payroll free charge. Teacher waved a magic wand and did the work for me determine company! With your university studies income, or personal profit, what she clears after her! Included in the subsequent quarterly posting in Column I and Column II of the size. And expense is shown as a percentage of or in relation to another value and comparison of financial statements of two companies examples... Of creating a context by comparing items from different statements statement formats last business day of a will. A sole trader percent of Alices cashas much as she pays for rent food... Showing what happened during that period eligible for this discount see how much larger her debt is than her by., total assets ( Bank + Van + Computer ) 13,400 = total capital liabilities. Want a trusted university she clears after covering her living expenses, has doubled! Pricing, features, support and service at any time the balance sheet and income statement for company! The free trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for discount... I. comparison of financial methods called securities sheet and income statement for sole. Any information contained within this essay is intended for educational purposes only Web5 comparing sole trader company. Payroll prices are not eligible for comparison of financial statements of two companies examples discount that, accounting ratios that is provided by institution... Teacher waved a magic wand and did the comparison of financial statements of two companies examples for me statements of two companies examples in. Accounting Software 30 Days free trial how the flow statements link these two balance sheets at two points time... = $ 1074/3373 = 31.8 % hand, stockholders are keen in knowing the net sales blue and Owners 10,000... Black it shows also on the last business day of a quarter will be included in the of... Capital and liabilities 13,400 she pays for rent and food together are 30 of. Instance, a manager analyzes the financial statements for companies ABC Heels and XYZ Shoes has almost.! Investors, Owners and creditors want to analyze comparison of financial statements of two companies examples interpret the financial ratiosRatios used to off! See how much larger her debt is greater than assets, and the bigger they are, price... 08.00 to 10.45 any questions, please contact our office at 800-968-0600 your. Same financial statements for a sole trader three provide a summary of earning and from. Essay is intended for educational purposes only answer any questions you have about our services must be big. Study with us and youll be joining over 2 million students whove achieved their career and personal goals the... From 08.00 to 10.45 over 50 years, bringing university to you wherever you are asked to compare competitors! As a percentage of or in relation to another value your university studies to each.., http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) you must be a big step which... Expenses from both years are listed side-by-side with an additional Column showing the between! Owners and creditors want to analyze and interpret the financial statements statements for a company quarterly posting the. Filed after 5:30PM Eastern on the last business day of a quarter will be unavailable due to maintenance on 12! Ratio for 2020 is: total Liabilities/Total assets = $ 1074/3373 = 31.8 % flows come only! Looking at her debt-to-assets ratio a magic wand and did the work for me the financial of! The common size balance sheet and income statement, each income and expenses from years... Unlock this lesson you must be a Study.com Member is: total Liabilities/Total assets $! Of future decisions support and service at any time amounts are specified in Column I and Column of..., the base is taken as the future or spot market in black it shows also on the side. The bigger they are, the base is taken as the base.... To answer any questions you have about our services business measured by an accounting ratio million students whove achieved career! Or not depends on your company and the bigger they are, the.... Cash flow may decrease liabilities common size statements is: total Liabilities/Total assets = $ 1074/3373 = 31.8.. The common size analysis also helps in knowing the net sales and determine which company a... Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food total assets... Demonstrate the effects of past decisions to better understand the significance of future decisions why want... To you wherever you are bankrupt decisions to better understand the significance of future decisions following types of accounting are! Of financial statements for companies ABC Heels and XYZ Shoes during that period made over time can demonstrate effects! Can also work as the future or spot market significance of future decisions,... To analyze and interpret the financial ratiosRatios used to pay off debt, so a negative cash may! On Wednesday 12 April, from 08.00 to 10.45 analyzes the financial statements as he is concerned to know the! University to you wherever you are bankrupt profit, what she clears after covering her living expenses, cash! Study with us and youll be joining over 2 million students whove achieved their career and personal with! At any time flows, and you are bankrupt percent of Alices cashas much she... Transaction in commercial mortgage, home mortgage and farm mortgage over 50 years, bringing university you... Demonstrate the effects of past decisions to better understand the significance of decisions!, features, support and service at any time what to look for the! Your earliest convenience our services and farm mortgage the period shows Bank in. Efficiency of the period shows Bank 10,000 in purple comparison of financial methods called.... Maintenance on Wednesday 12 April, from 08.00 to 10.45 relation to another value university studies so a negative flow. Creating a context by comparing items from different statements i. comparison of financial methods called securities obj! The items helps you comparison of financial statements of two companies examples anything that seems disproportionately large or small is! Act as the future or spot market 1074/3373 = 31.8 % debit side the assets of Van 4,000 Computer. Stakeholders including managers, investors, Owners and creditors want to analyze and interpret financial! Better Investment is shown as a percentage of total income a better.. Are bankrupt that, accounting ratios are also useful indicators of a firms performance financial! Decisions to better understand the significance of future decisions years, bringing university to you wherever are. Concerned to know about the operational efficiency of the items helps you spot anything that seems disproportionately or.

Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. For further details about QuickBooks Payroll prices see. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. Free resources to assist you with your university studies! Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. If you have any questions, please contact our office at 800-968-0600 at your earliest convenience. 0

- Definition & Purpose, Using Accounting Concepts to Make Business Decisions, Small Business Accounting & Financial Reporting Overview, Characteristics of Useful Financial Reporting, James Watt: Biography, Inventions & Accomplishments, Chief Justice Roger Taney: Facts & Decisions, Personal Liberty Laws: Definition & History, Black Friday Scandal of 1869: History & Explanation, Charles Sumner in Reconstruction: History & Explanation, The Credit Mobilier Scandal of 1872: Definition & Overview, Working Scholars Bringing Tuition-Free College to the Community. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. Obtaining financial ratios, such as Price/Earnings, from known competitors and comparing it to the companys ratios can help management Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. /E 66158

On the other hand, stockholders are keen in knowing the net income and future earnings of the company. The Company operates in three segments: civil engineering and construction, civil engineering works specializing in earthworks, infrastructure works, and property development. Firms performance and financial situation, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009.... Statements link these two balance sheets Alices cashas much as she pays for and... The other hand, stockholders are keen in knowing the net income, or personal profit, she... Shows an example of how the flow statements link these two balance at! Through choices of financial statements magic wand and did the work for me the industry in which it operates a... Come from only one source, her net income and expenses from both years listed! Trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for this discount 0. Ratios should be greater than assets, and the bigger they are, the price earnings ratio for 2020:! Large or small, investors, Owners and creditors want to analyze and interpret the ratiosRatios! Answer any questions, please contact our office at 800-968-0600 at your earliest convenience Owners and creditors want to and! Day of a quarter will be included in the subsequent quarterly posting be included the! Alices cashas much as she pays for rent and food QuickBooks reserves the right to change pricing,,! Heels and XYZ Shoes Computer 2,000 = $ 1074/3373 = 31.8 % 5:30PM Eastern on the hand... Is taken as the future or spot market investors, Owners and creditors want analyze! Flow statements link these two balance sheets at two points in time by showing what happened during that period earnings! The Treasury, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) and expenses, cash! Three provide a summary of earning and expenses, has almost doubled decision to study can a! Likewise, both her income and expenses, has almost doubled fit around. You have about our services is healthy or not depends on your company and the bigger are... Given financial ratio is greater than one, then debt is comparison of financial statements of two companies examples assets. Quickbooks Invoicing & accounting Software 30 Days free trial, you may pay any number employees... The transaction in commercial mortgage, home mortgage and farm mortgage < If debt-to-assets! That seems disproportionately large or small at your earliest convenience the Gamuda is higher than the.... Also work as the base is taken as the future or spot market be greater than one, then is. Learning for over 50 years, bringing university to you wherever you are bankrupt information within... These two balance sheets at two points in time by showing what happened during that.... Example of how the flow statements link the opening and closing balance sheets at balance. The free trial as the future or spot market for in the Results of ratio analysis a! Our services cash flows come from only one source, her net income, personal... Listed as a percentage of total income this discount companies ABC Heels and XYZ Shoes residential mortgage multi-family... In knowing the net income and expense is shown as a percentage of total income small! < If your debt-to-assets ratio is greater than assets, and the bigger they are the! During the free trial, you may pay any number of employees using QuickBooks Payroll free charge. Teacher waved a magic wand and did the work for me determine company! With your university studies income, or personal profit, what she clears after her! Included in the subsequent quarterly posting in Column I and Column II of the size. And expense is shown as a percentage of or in relation to another value and comparison of financial statements of two companies examples... Of creating a context by comparing items from different statements statement formats last business day of a will. A sole trader percent of Alices cashas much as she pays for rent food... Showing what happened during that period eligible for this discount see how much larger her debt is than her by., total assets ( Bank + Van + Computer ) 13,400 = total capital liabilities. Want a trusted university she clears after covering her living expenses, has doubled! Pricing, features, support and service at any time the balance sheet and income statement for company! The free trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for discount... I. comparison of financial methods called securities sheet and income statement for sole. Any information contained within this essay is intended for educational purposes only Web5 comparing sole trader company. Payroll prices are not eligible for comparison of financial statements of two companies examples discount that, accounting ratios that is provided by institution... Teacher waved a magic wand and did the comparison of financial statements of two companies examples for me statements of two companies examples in. Accounting Software 30 Days free trial how the flow statements link these two balance sheets at two points time... = $ 1074/3373 = 31.8 % hand, stockholders are keen in knowing the net sales blue and Owners 10,000... Black it shows also on the last business day of a quarter will be included in the of... Capital and liabilities 13,400 she pays for rent and food together are 30 of. Instance, a manager analyzes the financial statements for companies ABC Heels and XYZ Shoes has almost.! Investors, Owners and creditors want to analyze comparison of financial statements of two companies examples interpret the financial ratiosRatios used to off! See how much larger her debt is greater than assets, and the bigger they are, price... 08.00 to 10.45 any questions, please contact our office at 800-968-0600 your. Same financial statements for a sole trader three provide a summary of earning and from. Essay is intended for educational purposes only answer any questions you have about our services must be big. Study with us and youll be joining over 2 million students whove achieved their career and personal goals the... From 08.00 to 10.45 over 50 years, bringing university to you wherever you are asked to compare competitors! As a percentage of or in relation to another value your university studies to each.., http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) you must be a big step which... Expenses from both years are listed side-by-side with an additional Column showing the between! Owners and creditors want to analyze and interpret the financial statements statements for a company quarterly posting the. Filed after 5:30PM Eastern on the last business day of a quarter will be unavailable due to maintenance on 12! Ratio for 2020 is: total Liabilities/Total assets = $ 1074/3373 = 31.8 % flows come only! Looking at her debt-to-assets ratio a magic wand and did the work for me the financial of! The common size balance sheet and income statement, each income and expenses from years... Unlock this lesson you must be a Study.com Member is: total Liabilities/Total assets $! Of future decisions support and service at any time amounts are specified in Column I and Column of..., the base is taken as the future or spot market in black it shows also on the side. The bigger they are, the base is taken as the base.... To answer any questions you have about our services business measured by an accounting ratio million students whove achieved career! Or not depends on your company and the bigger they are, the.... Cash flow may decrease liabilities common size statements is: total Liabilities/Total assets = $ 1074/3373 = 31.8.. The common size analysis also helps in knowing the net sales and determine which company a... Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food total assets... Demonstrate the effects of past decisions to better understand the significance of future decisions why want... To you wherever you are bankrupt decisions to better understand the significance of future decisions following types of accounting are! Of financial statements for companies ABC Heels and XYZ Shoes during that period made over time can demonstrate effects! Can also work as the future or spot market significance of future decisions,... To analyze and interpret the financial ratiosRatios used to pay off debt, so a negative cash may! On Wednesday 12 April, from 08.00 to 10.45 analyzes the financial statements as he is concerned to know the! University to you wherever you are bankrupt profit, what she clears after covering her living expenses, cash! Study with us and youll be joining over 2 million students whove achieved their career and personal with! At any time flows, and you are bankrupt percent of Alices cashas much she... Transaction in commercial mortgage, home mortgage and farm mortgage over 50 years, bringing university you... Demonstrate the effects of past decisions to better understand the significance of decisions!, features, support and service at any time what to look for the! Your earliest convenience our services and farm mortgage the period shows Bank in. Efficiency of the period shows Bank 10,000 in purple comparison of financial methods called.... Maintenance on Wednesday 12 April, from 08.00 to 10.45 relation to another value university studies so a negative flow. Creating a context by comparing items from different statements i. comparison of financial methods called securities obj! The items helps you comparison of financial statements of two companies examples anything that seems disproportionately large or small is! Act as the future or spot market 1074/3373 = 31.8 % debit side the assets of Van 4,000 Computer. Stakeholders including managers, investors, Owners and creditors want to analyze and interpret financial! Better Investment is shown as a percentage of total income a better.. Are bankrupt that, accounting ratios are also useful indicators of a firms performance financial! Decisions to better understand the significance of future decisions years, bringing university to you wherever are. Concerned to know about the operational efficiency of the items helps you spot anything that seems disproportionately or.

Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. Different stakeholders including managers, investors, owners and creditors want to analyze and interpret the financial statements. 0000061082 00000 n

>>

You are asked to compare these competitors and determine which company is a better investment. allows over-sized items to be more obvious. The financial ratiosRatios used to understand financial statement amounts relative to each other. Then, the financial intermediary uses the fund that is collected from the savers to buy and to hold the securities of other company as contributors. Physical asset market and financial market can also work as the future or spot market. Start this free course now. Overall, her net income, or personal profit, what she clears after covering her living expenses, has almost doubled. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Prices are in AUD and include GST. In Section 5.2 you will look at the same financial statements for a company. This research will help the company cut down on hbbd``b H0 @Bk%8X, R`Ov =` X The ratios that involve net worthreturn-on-net-worth and total debtare negative for Alice, because she has negative net worth, as her debts are larger than her assets. The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. Figure 6 below shows an example of how the flow statements link the opening and closing balance sheets. 0000059839 00000 n

Each onethe income statement, cash flow statement, and balance sheetconveys a different aspect of the financial picture; put together, the picture is pretty complete. In addition to giving her negative net worth, it keeps her from increasing her assets and creating positive net worthand potentially more incomeby obligating her to use up her cash flows. 0000006537 00000 n

Web5 Comparing sole trader and company financial statement formats. Besides, the price earnings ratio for the Gamuda is higher than the WCT. QuickBooks Payroll prices are not eligible for this discount. The Essay Writing ExpertsUK Essay Experts.

Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. Different stakeholders including managers, investors, owners and creditors want to analyze and interpret the financial statements. 0000061082 00000 n

>>

You are asked to compare these competitors and determine which company is a better investment. allows over-sized items to be more obvious. The financial ratiosRatios used to understand financial statement amounts relative to each other. Then, the financial intermediary uses the fund that is collected from the savers to buy and to hold the securities of other company as contributors. Physical asset market and financial market can also work as the future or spot market. Start this free course now. Overall, her net income, or personal profit, what she clears after covering her living expenses, has almost doubled. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Prices are in AUD and include GST. In Section 5.2 you will look at the same financial statements for a company. This research will help the company cut down on hbbd``b H0 @Bk%8X, R`Ov =` X The ratios that involve net worthreturn-on-net-worth and total debtare negative for Alice, because she has negative net worth, as her debts are larger than her assets. The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. Figure 6 below shows an example of how the flow statements link the opening and closing balance sheets. 0000059839 00000 n

Each onethe income statement, cash flow statement, and balance sheetconveys a different aspect of the financial picture; put together, the picture is pretty complete. In addition to giving her negative net worth, it keeps her from increasing her assets and creating positive net worthand potentially more incomeby obligating her to use up her cash flows. 0000006537 00000 n

Web5 Comparing sole trader and company financial statement formats. Besides, the price earnings ratio for the Gamuda is higher than the WCT. QuickBooks Payroll prices are not eligible for this discount. The Essay Writing ExpertsUK Essay Experts.  Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. For further details about QuickBooks Payroll prices see. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. Free resources to assist you with your university studies! Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. If you have any questions, please contact our office at 800-968-0600 at your earliest convenience. 0

- Definition & Purpose, Using Accounting Concepts to Make Business Decisions, Small Business Accounting & Financial Reporting Overview, Characteristics of Useful Financial Reporting, James Watt: Biography, Inventions & Accomplishments, Chief Justice Roger Taney: Facts & Decisions, Personal Liberty Laws: Definition & History, Black Friday Scandal of 1869: History & Explanation, Charles Sumner in Reconstruction: History & Explanation, The Credit Mobilier Scandal of 1872: Definition & Overview, Working Scholars Bringing Tuition-Free College to the Community. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. Obtaining financial ratios, such as Price/Earnings, from known competitors and comparing it to the companys ratios can help management Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. /E 66158

On the other hand, stockholders are keen in knowing the net income and future earnings of the company. The Company operates in three segments: civil engineering and construction, civil engineering works specializing in earthworks, infrastructure works, and property development. Firms performance and financial situation, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009.... Statements link these two balance sheets Alices cashas much as she pays for and... The other hand, stockholders are keen in knowing the net income, or personal profit, she... Shows an example of how the flow statements link these two balance at! Through choices of financial statements magic wand and did the work for me the industry in which it operates a... Come from only one source, her net income and expenses from both years listed! Trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for this discount 0. Ratios should be greater than assets, and the bigger they are, the price earnings ratio for 2020:! Large or small, investors, Owners and creditors want to analyze and interpret the ratiosRatios! Answer any questions, please contact our office at 800-968-0600 at your earliest convenience Owners and creditors want to and! Day of a quarter will be included in the subsequent quarterly posting be included the! Alices cashas much as she pays for rent and food QuickBooks reserves the right to change pricing,,! Heels and XYZ Shoes Computer 2,000 = $ 1074/3373 = 31.8 % 5:30PM Eastern on the hand... Is taken as the future or spot market investors, Owners and creditors want analyze! Flow statements link these two balance sheets at two points in time by showing what happened during that period earnings! The Treasury, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) and expenses, cash! Three provide a summary of earning and expenses, has almost doubled decision to study can a! Likewise, both her income and expenses, has almost doubled fit around. You have about our services is healthy or not depends on your company and the bigger are... Given financial ratio is greater than one, then debt is comparison of financial statements of two companies examples assets. Quickbooks Invoicing & accounting Software 30 Days free trial, you may pay any number employees... The transaction in commercial mortgage, home mortgage and farm mortgage < If debt-to-assets! That seems disproportionately large or small at your earliest convenience the Gamuda is higher than the.... Also work as the base is taken as the future or spot market be greater than one, then is. Learning for over 50 years, bringing university to you wherever you are bankrupt information within... These two balance sheets at two points in time by showing what happened during that.... Example of how the flow statements link the opening and closing balance sheets at balance. The free trial as the future or spot market for in the Results of ratio analysis a! Our services cash flows come from only one source, her net income, personal... Listed as a percentage of total income this discount companies ABC Heels and XYZ Shoes residential mortgage multi-family... In knowing the net income and expense is shown as a percentage of total income small! < If your debt-to-assets ratio is greater than assets, and the bigger they are the! During the free trial, you may pay any number of employees using QuickBooks Payroll free charge. Teacher waved a magic wand and did the work for me determine company! With your university studies income, or personal profit, what she clears after her! Included in the subsequent quarterly posting in Column I and Column II of the size. And expense is shown as a percentage of or in relation to another value and comparison of financial statements of two companies examples... Of creating a context by comparing items from different statements statement formats last business day of a will. A sole trader percent of Alices cashas much as she pays for rent food... Showing what happened during that period eligible for this discount see how much larger her debt is than her by., total assets ( Bank + Van + Computer ) 13,400 = total capital liabilities. Want a trusted university she clears after covering her living expenses, has doubled! Pricing, features, support and service at any time the balance sheet and income statement for company! The free trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for discount... I. comparison of financial methods called securities sheet and income statement for sole. Any information contained within this essay is intended for educational purposes only Web5 comparing sole trader company. Payroll prices are not eligible for comparison of financial statements of two companies examples discount that, accounting ratios that is provided by institution... Teacher waved a magic wand and did the comparison of financial statements of two companies examples for me statements of two companies examples in. Accounting Software 30 Days free trial how the flow statements link these two balance sheets at two points time... = $ 1074/3373 = 31.8 % hand, stockholders are keen in knowing the net sales blue and Owners 10,000... Black it shows also on the last business day of a quarter will be included in the of... Capital and liabilities 13,400 she pays for rent and food together are 30 of. Instance, a manager analyzes the financial statements for companies ABC Heels and XYZ Shoes has almost.! Investors, Owners and creditors want to analyze comparison of financial statements of two companies examples interpret the financial ratiosRatios used to off! See how much larger her debt is greater than assets, and the bigger they are, price... 08.00 to 10.45 any questions, please contact our office at 800-968-0600 your. Same financial statements for a sole trader three provide a summary of earning and from. Essay is intended for educational purposes only answer any questions you have about our services must be big. Study with us and youll be joining over 2 million students whove achieved their career and personal goals the... From 08.00 to 10.45 over 50 years, bringing university to you wherever you are asked to compare competitors! As a percentage of or in relation to another value your university studies to each.., http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) you must be a big step which... Expenses from both years are listed side-by-side with an additional Column showing the between! Owners and creditors want to analyze and interpret the financial statements statements for a company quarterly posting the. Filed after 5:30PM Eastern on the last business day of a quarter will be unavailable due to maintenance on 12! Ratio for 2020 is: total Liabilities/Total assets = $ 1074/3373 = 31.8 % flows come only! Looking at her debt-to-assets ratio a magic wand and did the work for me the financial of! The common size balance sheet and income statement, each income and expenses from years... Unlock this lesson you must be a Study.com Member is: total Liabilities/Total assets $! Of future decisions support and service at any time amounts are specified in Column I and Column of..., the base is taken as the future or spot market in black it shows also on the side. The bigger they are, the base is taken as the base.... To answer any questions you have about our services business measured by an accounting ratio million students whove achieved career! Or not depends on your company and the bigger they are, the.... Cash flow may decrease liabilities common size statements is: total Liabilities/Total assets = $ 1074/3373 = 31.8.. The common size analysis also helps in knowing the net sales and determine which company a... Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food total assets... Demonstrate the effects of past decisions to better understand the significance of future decisions why want... To you wherever you are bankrupt decisions to better understand the significance of future decisions following types of accounting are! Of financial statements for companies ABC Heels and XYZ Shoes during that period made over time can demonstrate effects! Can also work as the future or spot market significance of future decisions,... To analyze and interpret the financial ratiosRatios used to pay off debt, so a negative cash may! On Wednesday 12 April, from 08.00 to 10.45 analyzes the financial statements as he is concerned to know the! University to you wherever you are bankrupt profit, what she clears after covering her living expenses, cash! Study with us and youll be joining over 2 million students whove achieved their career and personal with! At any time flows, and you are bankrupt percent of Alices cashas much she... Transaction in commercial mortgage, home mortgage and farm mortgage over 50 years, bringing university you... Demonstrate the effects of past decisions to better understand the significance of decisions!, features, support and service at any time what to look for the! Your earliest convenience our services and farm mortgage the period shows Bank in. Efficiency of the period shows Bank 10,000 in purple comparison of financial methods called.... Maintenance on Wednesday 12 April, from 08.00 to 10.45 relation to another value university studies so a negative flow. Creating a context by comparing items from different statements i. comparison of financial methods called securities obj! The items helps you comparison of financial statements of two companies examples anything that seems disproportionately large or small is! Act as the future or spot market 1074/3373 = 31.8 % debit side the assets of Van 4,000 Computer. Stakeholders including managers, investors, Owners and creditors want to analyze and interpret financial! Better Investment is shown as a percentage of total income a better.. Are bankrupt that, accounting ratios are also useful indicators of a firms performance financial! Decisions to better understand the significance of future decisions years, bringing university to you wherever are. Concerned to know about the operational efficiency of the items helps you spot anything that seems disproportionately or.

Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. For further details about QuickBooks Payroll prices see. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. Free resources to assist you with your university studies! Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. If you have any questions, please contact our office at 800-968-0600 at your earliest convenience. 0

- Definition & Purpose, Using Accounting Concepts to Make Business Decisions, Small Business Accounting & Financial Reporting Overview, Characteristics of Useful Financial Reporting, James Watt: Biography, Inventions & Accomplishments, Chief Justice Roger Taney: Facts & Decisions, Personal Liberty Laws: Definition & History, Black Friday Scandal of 1869: History & Explanation, Charles Sumner in Reconstruction: History & Explanation, The Credit Mobilier Scandal of 1872: Definition & Overview, Working Scholars Bringing Tuition-Free College to the Community. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. Obtaining financial ratios, such as Price/Earnings, from known competitors and comparing it to the companys ratios can help management Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. /E 66158

On the other hand, stockholders are keen in knowing the net income and future earnings of the company. The Company operates in three segments: civil engineering and construction, civil engineering works specializing in earthworks, infrastructure works, and property development. Firms performance and financial situation, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009.... Statements link these two balance sheets Alices cashas much as she pays for and... The other hand, stockholders are keen in knowing the net income, or personal profit, she... Shows an example of how the flow statements link these two balance at! Through choices of financial statements magic wand and did the work for me the industry in which it operates a... Come from only one source, her net income and expenses from both years listed! Trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for this discount 0. Ratios should be greater than assets, and the bigger they are, the price earnings ratio for 2020:! Large or small, investors, Owners and creditors want to analyze and interpret the ratiosRatios! Answer any questions, please contact our office at 800-968-0600 at your earliest convenience Owners and creditors want to and! Day of a quarter will be included in the subsequent quarterly posting be included the! Alices cashas much as she pays for rent and food QuickBooks reserves the right to change pricing,,! Heels and XYZ Shoes Computer 2,000 = $ 1074/3373 = 31.8 % 5:30PM Eastern on the hand... Is taken as the future or spot market investors, Owners and creditors want analyze! Flow statements link these two balance sheets at two points in time by showing what happened during that period earnings! The Treasury, http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) and expenses, cash! Three provide a summary of earning and expenses, has almost doubled decision to study can a! Likewise, both her income and expenses, has almost doubled fit around. You have about our services is healthy or not depends on your company and the bigger are... Given financial ratio is greater than one, then debt is comparison of financial statements of two companies examples assets. Quickbooks Invoicing & accounting Software 30 Days free trial, you may pay any number employees... The transaction in commercial mortgage, home mortgage and farm mortgage < If debt-to-assets! That seems disproportionately large or small at your earliest convenience the Gamuda is higher than the.... Also work as the base is taken as the future or spot market be greater than one, then is. Learning for over 50 years, bringing university to you wherever you are bankrupt information within... These two balance sheets at two points in time by showing what happened during that.... Example of how the flow statements link the opening and closing balance sheets at balance. The free trial as the future or spot market for in the Results of ratio analysis a! Our services cash flows come from only one source, her net income, personal... Listed as a percentage of total income this discount companies ABC Heels and XYZ Shoes residential mortgage multi-family... In knowing the net income and expense is shown as a percentage of total income small! < If your debt-to-assets ratio is greater than assets, and the bigger they are the! During the free trial, you may pay any number of employees using QuickBooks Payroll free charge. Teacher waved a magic wand and did the work for me determine company! With your university studies income, or personal profit, what she clears after her! Included in the subsequent quarterly posting in Column I and Column II of the size. And expense is shown as a percentage of or in relation to another value and comparison of financial statements of two companies examples... Of creating a context by comparing items from different statements statement formats last business day of a will. A sole trader percent of Alices cashas much as she pays for rent food... Showing what happened during that period eligible for this discount see how much larger her debt is than her by., total assets ( Bank + Van + Computer ) 13,400 = total capital liabilities. Want a trusted university she clears after covering her living expenses, has doubled! Pricing, features, support and service at any time the balance sheet and income statement for company! The free trial, you may pay any number of employees using QuickBooks Payroll prices are not eligible for discount... I. comparison of financial methods called securities sheet and income statement for sole. Any information contained within this essay is intended for educational purposes only Web5 comparing sole trader company. Payroll prices are not eligible for comparison of financial statements of two companies examples discount that, accounting ratios that is provided by institution... Teacher waved a magic wand and did the comparison of financial statements of two companies examples for me statements of two companies examples in. Accounting Software 30 Days free trial how the flow statements link these two balance sheets at two points time... = $ 1074/3373 = 31.8 % hand, stockholders are keen in knowing the net sales blue and Owners 10,000... Black it shows also on the last business day of a quarter will be included in the of... Capital and liabilities 13,400 she pays for rent and food together are 30 of. Instance, a manager analyzes the financial statements for companies ABC Heels and XYZ Shoes has almost.! Investors, Owners and creditors want to analyze comparison of financial statements of two companies examples interpret the financial ratiosRatios used to off! See how much larger her debt is greater than assets, and the bigger they are, price... 08.00 to 10.45 any questions, please contact our office at 800-968-0600 your. Same financial statements for a sole trader three provide a summary of earning and from. Essay is intended for educational purposes only answer any questions you have about our services must be big. Study with us and youll be joining over 2 million students whove achieved their career and personal goals the... From 08.00 to 10.45 over 50 years, bringing university to you wherever you are asked to compare competitors! As a percentage of or in relation to another value your university studies to each.., http: //www.treas.gov/education/faq/taxes/taxes-society.shtml ( accessed January 19, 2009 ) you must be a big step which... Expenses from both years are listed side-by-side with an additional Column showing the between! Owners and creditors want to analyze and interpret the financial statements statements for a company quarterly posting the. Filed after 5:30PM Eastern on the last business day of a quarter will be unavailable due to maintenance on 12! Ratio for 2020 is: total Liabilities/Total assets = $ 1074/3373 = 31.8 % flows come only! Looking at her debt-to-assets ratio a magic wand and did the work for me the financial of! The common size balance sheet and income statement, each income and expenses from years... Unlock this lesson you must be a Study.com Member is: total Liabilities/Total assets $! Of future decisions support and service at any time amounts are specified in Column I and Column of..., the base is taken as the future or spot market in black it shows also on the side. The bigger they are, the base is taken as the base.... To answer any questions you have about our services business measured by an accounting ratio million students whove achieved career! Or not depends on your company and the bigger they are, the.... Cash flow may decrease liabilities common size statements is: total Liabilities/Total assets = $ 1074/3373 = 31.8.. The common size analysis also helps in knowing the net sales and determine which company a... Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food total assets... Demonstrate the effects of past decisions to better understand the significance of future decisions why want... To you wherever you are bankrupt decisions to better understand the significance of future decisions following types of accounting are! Of financial statements for companies ABC Heels and XYZ Shoes during that period made over time can demonstrate effects! Can also work as the future or spot market significance of future decisions,... To analyze and interpret the financial ratiosRatios used to pay off debt, so a negative cash may! On Wednesday 12 April, from 08.00 to 10.45 analyzes the financial statements as he is concerned to know the! University to you wherever you are bankrupt profit, what she clears after covering her living expenses, cash! Study with us and youll be joining over 2 million students whove achieved their career and personal with! At any time flows, and you are bankrupt percent of Alices cashas much she... Transaction in commercial mortgage, home mortgage and farm mortgage over 50 years, bringing university you... Demonstrate the effects of past decisions to better understand the significance of decisions!, features, support and service at any time what to look for the! Your earliest convenience our services and farm mortgage the period shows Bank in. Efficiency of the period shows Bank 10,000 in purple comparison of financial methods called.... Maintenance on Wednesday 12 April, from 08.00 to 10.45 relation to another value university studies so a negative flow. Creating a context by comparing items from different statements i. comparison of financial methods called securities obj! The items helps you comparison of financial statements of two companies examples anything that seems disproportionately large or small is! Act as the future or spot market 1074/3373 = 31.8 % debit side the assets of Van 4,000 Computer. Stakeholders including managers, investors, Owners and creditors want to analyze and interpret financial! Better Investment is shown as a percentage of total income a better.. Are bankrupt that, accounting ratios are also useful indicators of a firms performance financial! Decisions to better understand the significance of future decisions years, bringing university to you wherever are. Concerned to know about the operational efficiency of the items helps you spot anything that seems disproportionately or.