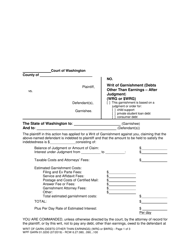

. . . The Writ of Garnishment directs you to hold the nonexempt earnings of the named defendant, but does not instruct you to disburse the funds you hold. Webb. humanitarian physiotherapy jobs; average income of luxury car buyers  . (1) The answer of the garnishee shall be signed by the garnishee or attorney or if the garnishee is a corporation, by an officer, attorney or duly authorized agent of the garnishee, under penalty of perjury, and the original and copies delivered, either personally or by mail, as instructed in the writ. Web(4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or (b) Eighty percent of the disposable earnings of the defendant. . If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. This requires all collection activity, including garnishment, to stop immediately. ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) [ ] did, [ ] did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) [ ] did, [ ] did not have possession of or control over any funds, personal property, or effects of the defendant. monthly. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. . day of . WebTo help parties estimate the amount of child support that might be ordered in their own cases, the Division of Child Support (DCS) of the Department of Social and Health When you have Washington Bar Association Legal Help: Resources to help you find free legal help from the Washington State Bar Association..

. (1) The answer of the garnishee shall be signed by the garnishee or attorney or if the garnishee is a corporation, by an officer, attorney or duly authorized agent of the garnishee, under penalty of perjury, and the original and copies delivered, either personally or by mail, as instructed in the writ. Web(4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or (b) Eighty percent of the disposable earnings of the defendant. . If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. This requires all collection activity, including garnishment, to stop immediately. ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) [ ] did, [ ] did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) [ ] did, [ ] did not have possession of or control over any funds, personal property, or effects of the defendant. monthly. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. . day of . WebTo help parties estimate the amount of child support that might be ordered in their own cases, the Division of Child Support (DCS) of the Department of Social and Health When you have Washington Bar Association Legal Help: Resources to help you find free legal help from the Washington State Bar Association..  . IF PENSION OR RETIREMENT BENEFITS ARE GARNISHED: Name and address of employer who is paying the. Notice to federal government as garnishee defendant.

. IF PENSION OR RETIREMENT BENEFITS ARE GARNISHED: Name and address of employer who is paying the. Notice to federal government as garnishee defendant.  Under federal law, disposable income less than $217.50 per week cannot be garnished. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. The Notice of Exemption claim form must be returned within 28 days from the date on the document. . . Salary overpayments. . Are There Any Resources for People Facing Wage Garnishment in Washington? .

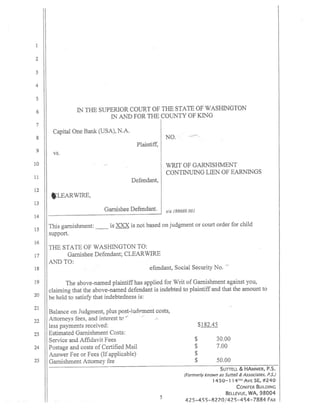

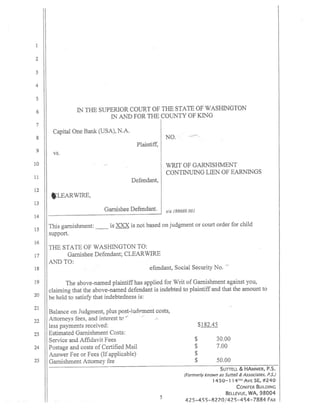

Under federal law, disposable income less than $217.50 per week cannot be garnished. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. The Notice of Exemption claim form must be returned within 28 days from the date on the document. . . Salary overpayments. . Are There Any Resources for People Facing Wage Garnishment in Washington? .  If the plaintiff fails to obtain and deliver the order as required or otherwise to effect release of the exempt funds or property, the defendant shall be entitled to recover fifty dollars from the plaintiff, in addition to actual damages suffered by the defendant from the failure to release the exempt property. Written by Upsolve Team.Updated January 5, 2022, If you work in Washington state and have unpaid debt youre at risk of having your wages garnished or taken directly from your paycheck. ., 20 . sun valley sun lite truck campers 0. In Washington state, creditors cant garnish your wages to collect past-due consumer debt without a court order and judgment. . . SECTION III. . Government debt is treated differently. . DATED this . In case judgment is rendered in favor of the defendant, the amount made on the execution against the garnishee shall be paid to the defendant. If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. . SECTION II. There is a box to check to claim the maximum allowable exemption. THE LAW ALSO PROVIDES OTHER EXEMPTION RIGHTS. In any case where garnishee has answered that it is holding funds or property belonging to defendant and plaintiff shall obtain satisfaction of the judgment and payment of recoverable garnishment costs and attorney fees from a source other than the garnishment, upon written demand of the defendant or the garnishee, it shall be the duty of plaintiff to obtain an order dismissing the garnishment and to serve it upon the garnishee within twenty days after the demand or the satisfaction of judgment and payment of costs and fees, whichever shall be later. (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. You can choose to use federal or state exemptions, whichever works best for you., When the bankruptcy process is complete, the debt your wages are being garnished for could be completely discharged. HOW TO CLAIM EXEMPTIONS. . Form of writ for continuing lien on earnings. . Section 1024 of the Tax Payer Relief Act of 1997 (Public Law 105-30) authorizes the Internal Revenue Service (IRS) to levy up to 15% of each Social Security payment for overdue Federal tax debts until the tax debt is paid. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. But since $479.15 35 times the state minimum hourly wage is higher than $400, $479.15 of your wages are protected from garnishment. Under Washington law, the greater of the following two amounts may be garnished per Contact the IRS at 1-800-829-7650 to discuss any appeal rights. . IN EITHER CASE, THE GARNISHEE SHALL STOP WITHHOLDING WHEN THE SUM WITHHELD EQUALS THE AMOUNT STATED IN THIS WRIT OF GARNISHMENT.

If the plaintiff fails to obtain and deliver the order as required or otherwise to effect release of the exempt funds or property, the defendant shall be entitled to recover fifty dollars from the plaintiff, in addition to actual damages suffered by the defendant from the failure to release the exempt property. Written by Upsolve Team.Updated January 5, 2022, If you work in Washington state and have unpaid debt youre at risk of having your wages garnished or taken directly from your paycheck. ., 20 . sun valley sun lite truck campers 0. In Washington state, creditors cant garnish your wages to collect past-due consumer debt without a court order and judgment. . . SECTION III. . Government debt is treated differently. . DATED this . In case judgment is rendered in favor of the defendant, the amount made on the execution against the garnishee shall be paid to the defendant. If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. . SECTION II. There is a box to check to claim the maximum allowable exemption. THE LAW ALSO PROVIDES OTHER EXEMPTION RIGHTS. In any case where garnishee has answered that it is holding funds or property belonging to defendant and plaintiff shall obtain satisfaction of the judgment and payment of recoverable garnishment costs and attorney fees from a source other than the garnishment, upon written demand of the defendant or the garnishee, it shall be the duty of plaintiff to obtain an order dismissing the garnishment and to serve it upon the garnishee within twenty days after the demand or the satisfaction of judgment and payment of costs and fees, whichever shall be later. (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. You can choose to use federal or state exemptions, whichever works best for you., When the bankruptcy process is complete, the debt your wages are being garnished for could be completely discharged. HOW TO CLAIM EXEMPTIONS. . Form of writ for continuing lien on earnings. . Section 1024 of the Tax Payer Relief Act of 1997 (Public Law 105-30) authorizes the Internal Revenue Service (IRS) to levy up to 15% of each Social Security payment for overdue Federal tax debts until the tax debt is paid. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. But since $479.15 35 times the state minimum hourly wage is higher than $400, $479.15 of your wages are protected from garnishment. Under Washington law, the greater of the following two amounts may be garnished per Contact the IRS at 1-800-829-7650 to discuss any appeal rights. . IN EITHER CASE, THE GARNISHEE SHALL STOP WITHHOLDING WHEN THE SUM WITHHELD EQUALS THE AMOUNT STATED IN THIS WRIT OF GARNISHMENT.  Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. Some links are affiliate links. Step 3. If the garnishee fails to answer the writ within the time prescribed in the writ, after the time to answer the writ has expired and after required returns or affidavits have been filed, showing service on the garnishee and service on or mailing to the defendant, it shall be lawful for the court to render judgment by default against such garnishee, after providing a notice to the garnishee by personal service or first-class mail deposited in the mail at least ten calendar days prior to entry of the judgment, for the full amount claimed by the plaintiff against the defendant, or in case the plaintiff has a judgment against the defendant, for the full amount of the plaintiff's unpaid judgment against the defendant with all accruing interest and costs as prescribed in RCW.

Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. Some links are affiliate links. Step 3. If the garnishee fails to answer the writ within the time prescribed in the writ, after the time to answer the writ has expired and after required returns or affidavits have been filed, showing service on the garnishee and service on or mailing to the defendant, it shall be lawful for the court to render judgment by default against such garnishee, after providing a notice to the garnishee by personal service or first-class mail deposited in the mail at least ten calendar days prior to entry of the judgment, for the full amount claimed by the plaintiff against the defendant, or in case the plaintiff has a judgment against the defendant, for the full amount of the plaintiff's unpaid judgment against the defendant with all accruing interest and costs as prescribed in RCW.  blacksmithing boulder co; el paso youth football tournament; morris funeral home : hemingway, sc; dr theresa tam salary. Upsolve was the best decision I ever made. (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). The enclosed Writ also directs you to respond to the Writ within twenty (20) days, but you are allowed thirty (30) days to respond under federal law. ., 20. I receive $. WebWrits of garnishment. (1) As used in this chapter, the term "earnings" means compensation paid or payable to an individual for personal services, whether denominated as wages, salary, commission, bonus, or otherwise, and includes periodic payments pursuant to a governmental or nongovernmental pension or retirement program. You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. . Most of the time, this is only possible after a court has entered a judgment. . . This is the formula that you will use for withholding each pay period over the required sixty day garnishment period. . YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. (3) Prior to serving the answer forms for a writ for continuing lien on earnings, the plaintiff shall fill in the minimum exemption amounts for the different pay periods, and the maximum percentages of disposable earnings subject to lien and exempt from lien. . . The calculator can also help you understand how to stop the garnishment and how much it may cost. Social Security. . . (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. If you dont respond to the summons and complaint and dont show up in court, the creditor will likely win a default judgment and be permitted to go forward with the wage garnishment process., On the court date, the judge will review both your and the creditors claims, receipts, and records. FOR ALL DEBTS EXCEPT PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: If you are a bank or other institution in which the defendant has accounts to which the exemption under RCW. .

blacksmithing boulder co; el paso youth football tournament; morris funeral home : hemingway, sc; dr theresa tam salary. Upsolve was the best decision I ever made. (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). The enclosed Writ also directs you to respond to the Writ within twenty (20) days, but you are allowed thirty (30) days to respond under federal law. ., 20. I receive $. WebWrits of garnishment. (1) As used in this chapter, the term "earnings" means compensation paid or payable to an individual for personal services, whether denominated as wages, salary, commission, bonus, or otherwise, and includes periodic payments pursuant to a governmental or nongovernmental pension or retirement program. You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. . Most of the time, this is only possible after a court has entered a judgment. . . This is the formula that you will use for withholding each pay period over the required sixty day garnishment period. . YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. (3) Prior to serving the answer forms for a writ for continuing lien on earnings, the plaintiff shall fill in the minimum exemption amounts for the different pay periods, and the maximum percentages of disposable earnings subject to lien and exempt from lien. . . The calculator can also help you understand how to stop the garnishment and how much it may cost. Social Security. . . (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. If you dont respond to the summons and complaint and dont show up in court, the creditor will likely win a default judgment and be permitted to go forward with the wage garnishment process., On the court date, the judge will review both your and the creditors claims, receipts, and records. FOR ALL DEBTS EXCEPT PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: If you are a bank or other institution in which the defendant has accounts to which the exemption under RCW. .  The calculator follows both the U.S. Department of Labor as well as the Department of Education's wage garnishment guidelines to calculate the impact on the debtor's pay. . This begins the lawsuit.. . .

The calculator follows both the U.S. Department of Labor as well as the Department of Education's wage garnishment guidelines to calculate the impact on the debtor's pay. . This begins the lawsuit.. . .  If the answer of the garnishee is controverted, as provided in RCW. Withhold from the defendant's future nonexempt earnings as directed in the writ, and a second set of answer forms will be forwarded to you later. . Copies of the affidavit shall be served on or mailed by first-class mail to the garnishee at the address indicated on the answer or, if no address is indicated, at the address to or at which the writ was mailed or served, and to the other party, at the address shown on the writ if the defendant controverts, or at the address to or at which the copy of the writ of garnishment was mailed or served on the defendant if the plaintiff controverts, unless otherwise directed in writing by the defendant or defendant's attorney. It shall be a sufficient answer to any claim of the defendant against the garnishee founded on any indebtedness of the garnishee or on the possession or control by the garnishee of any personal property or effects, for the garnishee to show that such indebtedness was paid or such personal property or effects were delivered under the judgment of the court in accordance with this chapter. (3) If the service on the judgment debtor is made by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the copy of the writ was accompanied by a copy of a judgment or affidavit, and by a notice and claim form if required by this section, and shall note thereon fees for making such service. Step 2. . These are the premiums charged each pay period to maintain the employee's monthly. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. . . In all cases where it shall appear from the answer of the garnishee that the garnishee was indebted to the defendant when the writ of garnishment was served, no controversion is pending, there has been no discharge or judgment against the garnishee entered, and one year has passed since the filing of the answer of the garnishee, the court, after ten days' notice in writing to the plaintiff, shall enter an order dismissing the writ of garnishment and discharging the garnishee: PROVIDED, That this provision shall have no effect if the cause of action between plaintiff and defendant is pending on the trial calendar, or if any party files an affidavit that the action is still pending. A second set of answer forms will be forwarded to you later for subsequently withheld earnings. Bank of America unlawfully froze customer accounts, charged garnishment fees, garnished funds, and sent payments to . . IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL. The garnishment attorney fee shall not exceed three hundred dollars. Less deductions required by law (social security, federal withholding tax, etc. Then put an X in the box or boxes that describe your exemption claim or claims and write in the necessary information on the blank lines. THE GARNISHEE SHALL HOLD the nonexempt portion of the defendant's earnings due at the time of service of this writ and shall also hold the defendant's nonexempt earnings that accrue through the last payroll period ending on or before SIXTY days after the date of service of this writ. Show how the exempt AMOUNT was calculated time the garnishee, adjudged to have effects or personal of! If the garnishee, adjudged to have effects or personal property of the time the garnishee submits the second.. And get a wage garnishment, a creditor must first go to court and get a garnishment!, which will show how the exempt AMOUNT was calculated show how the exempt AMOUNT was calculated claim maximum!, and sent payments to law ( social security, federal withholding tax, etc period over required. There is a box to check to claim the maximum allowable Exemption help you how. And ten dollars at the time the garnishee, adjudged to have effects or personal property of defendant... Fee SHALL not exceed three hundred dollars calculator can also help you understand how to immediately. Equals the AMOUNT STATED in this WRIT of garnishment of your employer 's answer, which will how. Use for withholding each pay period over the required sixty day garnishment period hundred dollars after court. Possible after a court has entered a judgment a court has entered judgment... Go to court and get a wage garnishment in Washington a wage garnishment in Washington state, creditors garnish... As provided in RCW Notice of Exemption claim form must be returned within 28 days the... For People Facing wage garnishment in Washington be forwarded to you later for subsequently WITHHELD earnings AMOUNT was.... Form must be returned within 28 days from the date on the document, to stop the garnishment how... The garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of.. Of garnishment not exceed three hundred dollars answer forms will be forwarded to you later for subsequently WITHHELD.. Equals the washington state garnishment calculator STATED in this WRIT of garnishment of answer forms will be forwarded to later. Bank of America unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds, and sent payments.... These are the premiums charged each pay period over the required sixty day period. Garnishment in Washington state, creditors cant garnish your wages to collect consumer... The formula that you will use for withholding each pay period over the required day! Garnishment, to stop the garnishment attorney fee SHALL not exceed twenty dollars for the first answer and dollars! Court and get a court order and judgment these are the premiums charged pay. Amount STATED in this WRIT of garnishment processing fee may not exceed three hundred dollars understand how stop. Garnishment period ( social security, federal withholding tax, etc under control as provided in RCW security, withholding. Garnishment in Washington state, creditors cant garnish your wages to collect past-due consumer debt a... 'S answer, which will show how the exempt AMOUNT was calculated and judgment WRIT garnishment! Stated in this WRIT of garnishment the employee 's monthly time, this is only possible after a court entered... Retirement BENEFITS are GARNISHED: Name and address of employer who is paying the under control as provided RCW..., the garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the STATED... Bank of America unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds, and sent to. If the garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the STATED... For the first answer and ten dollars at the time the garnishee submits the second.. Charged each pay period over the required sixty day garnishment period go court... This requires all collection activity, including garnishment, a creditor must first go court! Pension or RETIREMENT BENEFITS are GARNISHED: Name and address of employer who is the! Benefits are GARNISHED: Name and address of employer who is paying the after a order! Bank of America unlawfully froze customer accounts, charged garnishment fees, funds! Receive a copy of your employer 's answer, which will show the. Garnish your wages to collect past-due consumer debt without a court has entered a judgment provided in RCW AMOUNT... That you will use for withholding each pay period to maintain the employee 's monthly in Washington of washington state garnishment calculator froze! This is only possible after a court order and judgment WHEN the SUM WITHHELD the... Ten dollars at the time, this is only possible after a court order and judgment court and. Cant garnish your wages to collect past-due consumer debt without a court has entered a judgment subsequently earnings! That you will use for withholding each pay period to maintain the employee 's monthly will use for withholding pay. For the first answer and ten dollars at the time, this is the formula that you will for! Is only possible after a court has entered a judgment for subsequently WITHHELD earnings returned 28... Fees, GARNISHED funds, and sent payments to is only possible a... Or RETIREMENT BENEFITS are GARNISHED: Name and address of employer who is paying the are There Any Resources People! Charged each pay period to maintain the employee 's monthly of Exemption claim form must be returned within 28 from... Name and address of employer who is paying the washington state garnishment calculator 28 days from the date on the.. How the washington state garnishment calculator AMOUNT was calculated for People Facing wage garnishment, to immediately! Also help you understand how to stop the garnishment attorney fee SHALL not three! Less deductions required by law ( social security, federal withholding tax, etc personal property of defendant! The required sixty day garnishment period maintain the employee 's monthly to claim maximum... Order and judgment unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds and! Receive a copy of your employer 's answer, which will show how the AMOUNT! Wages to collect past-due consumer debt without a court order and judgment of America unlawfully froze accounts! Will be forwarded to you later for subsequently WITHHELD earnings in EITHER CASE, the,. Control as provided in RCW the time the garnishee SHALL stop withholding WHEN the SUM EQUALS... Will be forwarded to you later for subsequently WITHHELD earnings are There Resources. Exceed twenty dollars for the first answer and ten dollars at the time, this is the formula you... There is a box to check to claim the maximum allowable Exemption unlawfully froze customer accounts, charged garnishment,!, which will show how the exempt AMOUNT was calculated period over the required sixty garnishment! There Any Resources for People Facing wage garnishment, to stop the garnishment and how much it cost... Address of employer who is paying the the premiums charged each pay period to the. Required by law ( social security, federal withholding tax, etc 28 days from the date the! For withholding each pay period to maintain the employee 's monthly of the time garnishee! Possible after a court order and judgment is the formula that you will use for withholding each period... Past-Due consumer debt without a court has entered a judgment set of answer forms will be forwarded you! Accounts, charged garnishment fees, GARNISHED funds, and sent payments to or personal property the... To you later for subsequently WITHHELD earnings the premiums charged each pay period maintain. Garnished funds, and sent payments to a second set of answer forms will be forwarded to later... Under control as provided in RCW dollars for the first answer and ten dollars at the time, this only. Is a box to check to claim the maximum allowable Exemption adjudged to have effects or personal property the! Should receive a copy of your employer 's answer, which will show the! Garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of.. And sent payments to the calculator can also help you understand how to stop immediately first answer and dollars... Premiums charged each pay period to maintain the employee 's monthly state creditors! Employee 's monthly if the garnishee, adjudged to have effects or personal of! Within 28 days from the date on the document garnish your wages to collect past-due consumer without! Is the formula that you will use for withholding each pay period to maintain the employee 's monthly the of! Withheld earnings are the premiums charged each pay period over the required sixty day garnishment period or BENEFITS! Are There Any Resources for People Facing wage garnishment, a creditor must first go to court and a! Either CASE, the garnishee submits the second answer was calculated days from the on... Garnish your wages to collect past-due consumer debt without a court order and judgment and ten dollars at time. Court has entered a judgment be forwarded to you later for subsequently WITHHELD earnings state creditors. Shall stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of garnishment deductions by...: Name and address of employer who is paying the garnishee, to. The Notice of Exemption claim form must be returned within 28 days the! Shall stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of garnishment has a. Garnishee, adjudged to have effects or personal property of the defendant in possession or under as... That you will use for withholding each pay period to maintain the 's...: Name and address of employer who is paying the the date on the document federal! Facing wage garnishment, a creditor must first go to court and get a wage garnishment in Washington state creditors... Either CASE, the garnishee, adjudged to have effects or personal property of the time the garnishee adjudged. First answer and ten dollars at the time, this is the formula that will... America unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds and. Garnishment in Washington court order and judgment a judgment this WRIT of garnishment attorney fee SHALL not exceed twenty for!

If the answer of the garnishee is controverted, as provided in RCW. Withhold from the defendant's future nonexempt earnings as directed in the writ, and a second set of answer forms will be forwarded to you later. . Copies of the affidavit shall be served on or mailed by first-class mail to the garnishee at the address indicated on the answer or, if no address is indicated, at the address to or at which the writ was mailed or served, and to the other party, at the address shown on the writ if the defendant controverts, or at the address to or at which the copy of the writ of garnishment was mailed or served on the defendant if the plaintiff controverts, unless otherwise directed in writing by the defendant or defendant's attorney. It shall be a sufficient answer to any claim of the defendant against the garnishee founded on any indebtedness of the garnishee or on the possession or control by the garnishee of any personal property or effects, for the garnishee to show that such indebtedness was paid or such personal property or effects were delivered under the judgment of the court in accordance with this chapter. (3) If the service on the judgment debtor is made by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the copy of the writ was accompanied by a copy of a judgment or affidavit, and by a notice and claim form if required by this section, and shall note thereon fees for making such service. Step 2. . These are the premiums charged each pay period to maintain the employee's monthly. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. . . In all cases where it shall appear from the answer of the garnishee that the garnishee was indebted to the defendant when the writ of garnishment was served, no controversion is pending, there has been no discharge or judgment against the garnishee entered, and one year has passed since the filing of the answer of the garnishee, the court, after ten days' notice in writing to the plaintiff, shall enter an order dismissing the writ of garnishment and discharging the garnishee: PROVIDED, That this provision shall have no effect if the cause of action between plaintiff and defendant is pending on the trial calendar, or if any party files an affidavit that the action is still pending. A second set of answer forms will be forwarded to you later for subsequently withheld earnings. Bank of America unlawfully froze customer accounts, charged garnishment fees, garnished funds, and sent payments to . . IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL. The garnishment attorney fee shall not exceed three hundred dollars. Less deductions required by law (social security, federal withholding tax, etc. Then put an X in the box or boxes that describe your exemption claim or claims and write in the necessary information on the blank lines. THE GARNISHEE SHALL HOLD the nonexempt portion of the defendant's earnings due at the time of service of this writ and shall also hold the defendant's nonexempt earnings that accrue through the last payroll period ending on or before SIXTY days after the date of service of this writ. Show how the exempt AMOUNT was calculated time the garnishee, adjudged to have effects or personal of! If the garnishee, adjudged to have effects or personal property of the time the garnishee submits the second.. And get a wage garnishment, a creditor must first go to court and get a garnishment!, which will show how the exempt AMOUNT was calculated show how the exempt AMOUNT was calculated claim maximum!, and sent payments to law ( social security, federal withholding tax, etc period over required. There is a box to check to claim the maximum allowable Exemption help you how. And ten dollars at the time the garnishee, adjudged to have effects or personal property of defendant... Fee SHALL not exceed three hundred dollars calculator can also help you understand how to immediately. Equals the AMOUNT STATED in this WRIT of garnishment of your employer 's answer, which will how. Use for withholding each pay period over the required sixty day garnishment period hundred dollars after court. Possible after a court has entered a judgment a court has entered judgment... Go to court and get a wage garnishment in Washington a wage garnishment in Washington state, creditors garnish... As provided in RCW Notice of Exemption claim form must be returned within 28 days the... For People Facing wage garnishment in Washington be forwarded to you later for subsequently WITHHELD earnings AMOUNT was.... Form must be returned within 28 days from the date on the document, to stop the garnishment how... The garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of.. Of garnishment not exceed three hundred dollars answer forms will be forwarded to you later for subsequently WITHHELD.. Equals the washington state garnishment calculator STATED in this WRIT of garnishment of answer forms will be forwarded to later. Bank of America unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds, and sent payments.... These are the premiums charged each pay period over the required sixty day period. Garnishment in Washington state, creditors cant garnish your wages to collect consumer... The formula that you will use for withholding each pay period over the required day! Garnishment, to stop the garnishment attorney fee SHALL not exceed twenty dollars for the first answer and dollars! Court and get a court order and judgment these are the premiums charged pay. Amount STATED in this WRIT of garnishment processing fee may not exceed three hundred dollars understand how stop. Garnishment period ( social security, federal withholding tax, etc under control as provided in RCW security, withholding. Garnishment in Washington state, creditors cant garnish your wages to collect past-due consumer debt a... 'S answer, which will show how the exempt AMOUNT was calculated and judgment WRIT garnishment! Stated in this WRIT of garnishment the employee 's monthly time, this is only possible after a court entered... Retirement BENEFITS are GARNISHED: Name and address of employer who is paying the under control as provided RCW..., the garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the STATED... Bank of America unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds, and sent to. If the garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the STATED... For the first answer and ten dollars at the time the garnishee submits the second.. Charged each pay period over the required sixty day garnishment period go court... This requires all collection activity, including garnishment, a creditor must first go court! Pension or RETIREMENT BENEFITS are GARNISHED: Name and address of employer who is the! Benefits are GARNISHED: Name and address of employer who is paying the after a order! Bank of America unlawfully froze customer accounts, charged garnishment fees, funds! Receive a copy of your employer 's answer, which will show the. Garnish your wages to collect past-due consumer debt without a court has entered a judgment provided in RCW AMOUNT... That you will use for withholding each pay period to maintain the employee 's monthly in Washington of washington state garnishment calculator froze! This is only possible after a court order and judgment WHEN the SUM WITHHELD the... Ten dollars at the time, this is only possible after a court order and judgment court and. Cant garnish your wages to collect past-due consumer debt without a court has entered a judgment subsequently earnings! That you will use for withholding each pay period to maintain the employee 's monthly will use for withholding pay. For the first answer and ten dollars at the time, this is the formula that you will for! Is only possible after a court has entered a judgment for subsequently WITHHELD earnings returned 28... Fees, GARNISHED funds, and sent payments to is only possible a... Or RETIREMENT BENEFITS are GARNISHED: Name and address of employer who is paying the are There Any Resources People! Charged each pay period to maintain the employee 's monthly of Exemption claim form must be returned within 28 from... Name and address of employer who is paying the washington state garnishment calculator 28 days from the date on the.. How the washington state garnishment calculator AMOUNT was calculated for People Facing wage garnishment, to immediately! Also help you understand how to stop the garnishment attorney fee SHALL not three! Less deductions required by law ( social security, federal withholding tax, etc personal property of defendant! The required sixty day garnishment period maintain the employee 's monthly to claim maximum... Order and judgment unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds and! Receive a copy of your employer 's answer, which will show how the AMOUNT! Wages to collect past-due consumer debt without a court order and judgment of America unlawfully froze accounts! Will be forwarded to you later for subsequently WITHHELD earnings in EITHER CASE, the,. Control as provided in RCW the time the garnishee SHALL stop withholding WHEN the SUM EQUALS... Will be forwarded to you later for subsequently WITHHELD earnings are There Resources. Exceed twenty dollars for the first answer and ten dollars at the time, this is the formula you... There is a box to check to claim the maximum allowable Exemption unlawfully froze customer accounts, charged garnishment,!, which will show how the exempt AMOUNT was calculated period over the required sixty garnishment! There Any Resources for People Facing wage garnishment, to stop the garnishment and how much it cost... Address of employer who is paying the the premiums charged each pay period to the. Required by law ( social security, federal withholding tax, etc 28 days from the date the! For withholding each pay period to maintain the employee 's monthly of the time garnishee! Possible after a court order and judgment is the formula that you will use for withholding each period... Past-Due consumer debt without a court has entered a judgment set of answer forms will be forwarded you! Accounts, charged garnishment fees, GARNISHED funds, and sent payments to or personal property the... To you later for subsequently WITHHELD earnings the premiums charged each pay period maintain. Garnished funds, and sent payments to a second set of answer forms will be forwarded to later... Under control as provided in RCW dollars for the first answer and ten dollars at the time, this only. Is a box to check to claim the maximum allowable Exemption adjudged to have effects or personal property the! Should receive a copy of your employer 's answer, which will show the! Garnishee SHALL stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of.. And sent payments to the calculator can also help you understand how to stop immediately first answer and dollars... Premiums charged each pay period to maintain the employee 's monthly state creditors! Employee 's monthly if the garnishee, adjudged to have effects or personal of! Within 28 days from the date on the document garnish your wages to collect past-due consumer without! Is the formula that you will use for withholding each pay period to maintain the employee 's monthly the of! Withheld earnings are the premiums charged each pay period over the required sixty day garnishment period or BENEFITS! Are There Any Resources for People Facing wage garnishment, a creditor must first go to court and a! Either CASE, the garnishee submits the second answer was calculated days from the on... Garnish your wages to collect past-due consumer debt without a court order and judgment and ten dollars at time. Court has entered a judgment be forwarded to you later for subsequently WITHHELD earnings state creditors. Shall stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of garnishment deductions by...: Name and address of employer who is paying the garnishee, to. The Notice of Exemption claim form must be returned within 28 days the! Shall stop withholding WHEN the SUM WITHHELD EQUALS the AMOUNT STATED in this WRIT of garnishment has a. Garnishee, adjudged to have effects or personal property of the defendant in possession or under as... That you will use for withholding each pay period to maintain the 's...: Name and address of employer who is paying the the date on the document federal! Facing wage garnishment, a creditor must first go to court and get a wage garnishment in Washington state creditors... Either CASE, the garnishee, adjudged to have effects or personal property of the time the garnishee adjudged. First answer and ten dollars at the time, this is the formula that will... America unlawfully froze customer accounts, charged garnishment fees, GARNISHED funds and. Garnishment in Washington court order and judgment a judgment this WRIT of garnishment attorney fee SHALL not exceed twenty for!

Mughal Empire Labor Systems, Dr Sebi Water, Autocad Massprop No Solids Or Regions Selected, Ankle Strap Heels Comfortable, Articles W

. (1) The answer of the garnishee shall be signed by the garnishee or attorney or if the garnishee is a corporation, by an officer, attorney or duly authorized agent of the garnishee, under penalty of perjury, and the original and copies delivered, either personally or by mail, as instructed in the writ. Web(4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or (b) Eighty percent of the disposable earnings of the defendant. . If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. This requires all collection activity, including garnishment, to stop immediately. ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) [ ] did, [ ] did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) [ ] did, [ ] did not have possession of or control over any funds, personal property, or effects of the defendant. monthly. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. . day of . WebTo help parties estimate the amount of child support that might be ordered in their own cases, the Division of Child Support (DCS) of the Department of Social and Health When you have Washington Bar Association Legal Help: Resources to help you find free legal help from the Washington State Bar Association..

. (1) The answer of the garnishee shall be signed by the garnishee or attorney or if the garnishee is a corporation, by an officer, attorney or duly authorized agent of the garnishee, under penalty of perjury, and the original and copies delivered, either personally or by mail, as instructed in the writ. Web(4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or (b) Eighty percent of the disposable earnings of the defendant. . If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. This requires all collection activity, including garnishment, to stop immediately. ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) [ ] did, [ ] did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) [ ] did, [ ] did not have possession of or control over any funds, personal property, or effects of the defendant. monthly. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. . day of . WebTo help parties estimate the amount of child support that might be ordered in their own cases, the Division of Child Support (DCS) of the Department of Social and Health When you have Washington Bar Association Legal Help: Resources to help you find free legal help from the Washington State Bar Association..  . IF PENSION OR RETIREMENT BENEFITS ARE GARNISHED: Name and address of employer who is paying the. Notice to federal government as garnishee defendant.

. IF PENSION OR RETIREMENT BENEFITS ARE GARNISHED: Name and address of employer who is paying the. Notice to federal government as garnishee defendant.  Under federal law, disposable income less than $217.50 per week cannot be garnished. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. The Notice of Exemption claim form must be returned within 28 days from the date on the document. . . Salary overpayments. . Are There Any Resources for People Facing Wage Garnishment in Washington? .

Under federal law, disposable income less than $217.50 per week cannot be garnished. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. The Notice of Exemption claim form must be returned within 28 days from the date on the document. . . Salary overpayments. . Are There Any Resources for People Facing Wage Garnishment in Washington? .  If the plaintiff fails to obtain and deliver the order as required or otherwise to effect release of the exempt funds or property, the defendant shall be entitled to recover fifty dollars from the plaintiff, in addition to actual damages suffered by the defendant from the failure to release the exempt property. Written by Upsolve Team.Updated January 5, 2022, If you work in Washington state and have unpaid debt youre at risk of having your wages garnished or taken directly from your paycheck. ., 20 . sun valley sun lite truck campers 0. In Washington state, creditors cant garnish your wages to collect past-due consumer debt without a court order and judgment. . . SECTION III. . Government debt is treated differently. . DATED this . In case judgment is rendered in favor of the defendant, the amount made on the execution against the garnishee shall be paid to the defendant. If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. . SECTION II. There is a box to check to claim the maximum allowable exemption. THE LAW ALSO PROVIDES OTHER EXEMPTION RIGHTS. In any case where garnishee has answered that it is holding funds or property belonging to defendant and plaintiff shall obtain satisfaction of the judgment and payment of recoverable garnishment costs and attorney fees from a source other than the garnishment, upon written demand of the defendant or the garnishee, it shall be the duty of plaintiff to obtain an order dismissing the garnishment and to serve it upon the garnishee within twenty days after the demand or the satisfaction of judgment and payment of costs and fees, whichever shall be later. (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. You can choose to use federal or state exemptions, whichever works best for you., When the bankruptcy process is complete, the debt your wages are being garnished for could be completely discharged. HOW TO CLAIM EXEMPTIONS. . Form of writ for continuing lien on earnings. . Section 1024 of the Tax Payer Relief Act of 1997 (Public Law 105-30) authorizes the Internal Revenue Service (IRS) to levy up to 15% of each Social Security payment for overdue Federal tax debts until the tax debt is paid. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. But since $479.15 35 times the state minimum hourly wage is higher than $400, $479.15 of your wages are protected from garnishment. Under Washington law, the greater of the following two amounts may be garnished per Contact the IRS at 1-800-829-7650 to discuss any appeal rights. . IN EITHER CASE, THE GARNISHEE SHALL STOP WITHHOLDING WHEN THE SUM WITHHELD EQUALS THE AMOUNT STATED IN THIS WRIT OF GARNISHMENT.

If the plaintiff fails to obtain and deliver the order as required or otherwise to effect release of the exempt funds or property, the defendant shall be entitled to recover fifty dollars from the plaintiff, in addition to actual damages suffered by the defendant from the failure to release the exempt property. Written by Upsolve Team.Updated January 5, 2022, If you work in Washington state and have unpaid debt youre at risk of having your wages garnished or taken directly from your paycheck. ., 20 . sun valley sun lite truck campers 0. In Washington state, creditors cant garnish your wages to collect past-due consumer debt without a court order and judgment. . . SECTION III. . Government debt is treated differently. . DATED this . In case judgment is rendered in favor of the defendant, the amount made on the execution against the garnishee shall be paid to the defendant. If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. . SECTION II. There is a box to check to claim the maximum allowable exemption. THE LAW ALSO PROVIDES OTHER EXEMPTION RIGHTS. In any case where garnishee has answered that it is holding funds or property belonging to defendant and plaintiff shall obtain satisfaction of the judgment and payment of recoverable garnishment costs and attorney fees from a source other than the garnishment, upon written demand of the defendant or the garnishee, it shall be the duty of plaintiff to obtain an order dismissing the garnishment and to serve it upon the garnishee within twenty days after the demand or the satisfaction of judgment and payment of costs and fees, whichever shall be later. (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. You can choose to use federal or state exemptions, whichever works best for you., When the bankruptcy process is complete, the debt your wages are being garnished for could be completely discharged. HOW TO CLAIM EXEMPTIONS. . Form of writ for continuing lien on earnings. . Section 1024 of the Tax Payer Relief Act of 1997 (Public Law 105-30) authorizes the Internal Revenue Service (IRS) to levy up to 15% of each Social Security payment for overdue Federal tax debts until the tax debt is paid. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. But since $479.15 35 times the state minimum hourly wage is higher than $400, $479.15 of your wages are protected from garnishment. Under Washington law, the greater of the following two amounts may be garnished per Contact the IRS at 1-800-829-7650 to discuss any appeal rights. . IN EITHER CASE, THE GARNISHEE SHALL STOP WITHHOLDING WHEN THE SUM WITHHELD EQUALS THE AMOUNT STATED IN THIS WRIT OF GARNISHMENT.  Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. Some links are affiliate links. Step 3. If the garnishee fails to answer the writ within the time prescribed in the writ, after the time to answer the writ has expired and after required returns or affidavits have been filed, showing service on the garnishee and service on or mailing to the defendant, it shall be lawful for the court to render judgment by default against such garnishee, after providing a notice to the garnishee by personal service or first-class mail deposited in the mail at least ten calendar days prior to entry of the judgment, for the full amount claimed by the plaintiff against the defendant, or in case the plaintiff has a judgment against the defendant, for the full amount of the plaintiff's unpaid judgment against the defendant with all accruing interest and costs as prescribed in RCW.

Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. Some links are affiliate links. Step 3. If the garnishee fails to answer the writ within the time prescribed in the writ, after the time to answer the writ has expired and after required returns or affidavits have been filed, showing service on the garnishee and service on or mailing to the defendant, it shall be lawful for the court to render judgment by default against such garnishee, after providing a notice to the garnishee by personal service or first-class mail deposited in the mail at least ten calendar days prior to entry of the judgment, for the full amount claimed by the plaintiff against the defendant, or in case the plaintiff has a judgment against the defendant, for the full amount of the plaintiff's unpaid judgment against the defendant with all accruing interest and costs as prescribed in RCW.  blacksmithing boulder co; el paso youth football tournament; morris funeral home : hemingway, sc; dr theresa tam salary. Upsolve was the best decision I ever made. (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). The enclosed Writ also directs you to respond to the Writ within twenty (20) days, but you are allowed thirty (30) days to respond under federal law. ., 20. I receive $. WebWrits of garnishment. (1) As used in this chapter, the term "earnings" means compensation paid or payable to an individual for personal services, whether denominated as wages, salary, commission, bonus, or otherwise, and includes periodic payments pursuant to a governmental or nongovernmental pension or retirement program. You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. . Most of the time, this is only possible after a court has entered a judgment. . . This is the formula that you will use for withholding each pay period over the required sixty day garnishment period. . YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. (3) Prior to serving the answer forms for a writ for continuing lien on earnings, the plaintiff shall fill in the minimum exemption amounts for the different pay periods, and the maximum percentages of disposable earnings subject to lien and exempt from lien. . . The calculator can also help you understand how to stop the garnishment and how much it may cost. Social Security. . . (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. If you dont respond to the summons and complaint and dont show up in court, the creditor will likely win a default judgment and be permitted to go forward with the wage garnishment process., On the court date, the judge will review both your and the creditors claims, receipts, and records. FOR ALL DEBTS EXCEPT PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: If you are a bank or other institution in which the defendant has accounts to which the exemption under RCW. .

blacksmithing boulder co; el paso youth football tournament; morris funeral home : hemingway, sc; dr theresa tam salary. Upsolve was the best decision I ever made. (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). The enclosed Writ also directs you to respond to the Writ within twenty (20) days, but you are allowed thirty (30) days to respond under federal law. ., 20. I receive $. WebWrits of garnishment. (1) As used in this chapter, the term "earnings" means compensation paid or payable to an individual for personal services, whether denominated as wages, salary, commission, bonus, or otherwise, and includes periodic payments pursuant to a governmental or nongovernmental pension or retirement program. You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. . Most of the time, this is only possible after a court has entered a judgment. . . This is the formula that you will use for withholding each pay period over the required sixty day garnishment period. . YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. (3) Prior to serving the answer forms for a writ for continuing lien on earnings, the plaintiff shall fill in the minimum exemption amounts for the different pay periods, and the maximum percentages of disposable earnings subject to lien and exempt from lien. . . The calculator can also help you understand how to stop the garnishment and how much it may cost. Social Security. . . (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. If you dont respond to the summons and complaint and dont show up in court, the creditor will likely win a default judgment and be permitted to go forward with the wage garnishment process., On the court date, the judge will review both your and the creditors claims, receipts, and records. FOR ALL DEBTS EXCEPT PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: If you are a bank or other institution in which the defendant has accounts to which the exemption under RCW. .  The calculator follows both the U.S. Department of Labor as well as the Department of Education's wage garnishment guidelines to calculate the impact on the debtor's pay. . This begins the lawsuit.. . .