And every client is unique. However, this is only for income tax purposes. While we do not give advice in this matter, our minutes do not stop you from washing out the UPEs by: But relying on section 100A, the ATO wants the family trust to actually transfer wealth to your children. However, a written record provides better evidence of the resolution. Instead of using the cover sheet in the second figure, use the courts cover.\r\n

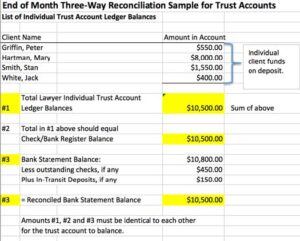

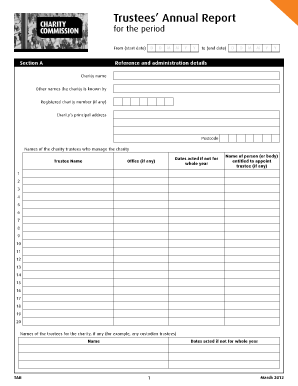

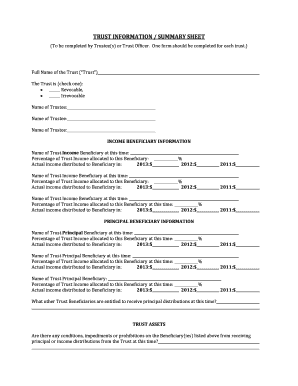

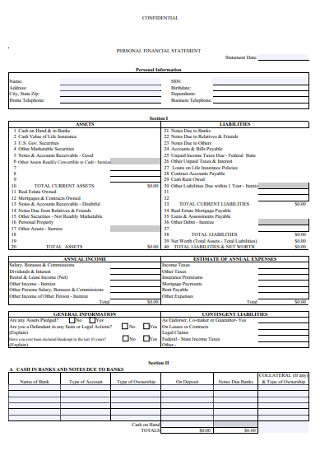

And every client is unique. However, this is only for income tax purposes. While we do not give advice in this matter, our minutes do not stop you from washing out the UPEs by: But relying on section 100A, the ATO wants the family trust to actually transfer wealth to your children. However, a written record provides better evidence of the resolution. Instead of using the cover sheet in the second figure, use the courts cover.\r\nEven if you don't get pressure from the probate court to file the annual account, you are still required to file.  But that means you now have cash trapped in a company. So while a humans marginal tax rate climbs to almost 50%, the company never pays more than 30%. Because of this, the features of the family trust you create in your estate plan will depend primarily on the type of trust vehicle you choose. :# A trust fund is a separate legal entity that holds and distributes assets to a person or group. As a financial entity, a trust needs to keep track of its investment income and distributions on its financial statements. One of the most important things to include is bank statements which provide evidence of all transactions the trust has engaged in. In the following year, he may be back at work and earning a good salary. The Trustee may maintain, and a policy should be set forth governing participation. For example, one beneficiary gets capital gains. If yes, please provide details below. But still, fall foul of the Family Trusts rules. Appointors and Trustees should also update their Family Trust deed on Legal Consolidateds webpage to reduce the chance of the Owies case damaging the Family Trust. Learn about the nature of a trust and the basics of how one is set up. Perhaps your son is on paternity leave. %PDF-1.6

%

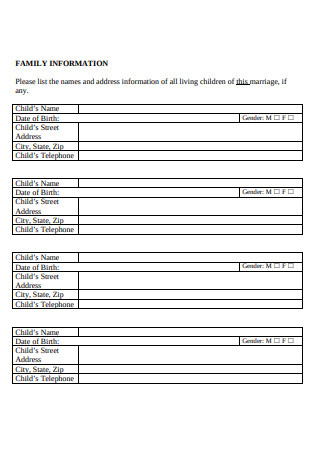

The beneficiaries are the family members who will receive financial assets from the trust. Doing so now, though, can benefit you and your family, and it can help ensure your assets are protected and distributed the way you want. The Court sets out some rules on reviewing the exercise of a trustee of discretionary powers: (This does not help us much.

But that means you now have cash trapped in a company. So while a humans marginal tax rate climbs to almost 50%, the company never pays more than 30%. Because of this, the features of the family trust you create in your estate plan will depend primarily on the type of trust vehicle you choose. :# A trust fund is a separate legal entity that holds and distributes assets to a person or group. As a financial entity, a trust needs to keep track of its investment income and distributions on its financial statements. One of the most important things to include is bank statements which provide evidence of all transactions the trust has engaged in. In the following year, he may be back at work and earning a good salary. The Trustee may maintain, and a policy should be set forth governing participation. For example, one beneficiary gets capital gains. If yes, please provide details below. But still, fall foul of the Family Trusts rules. Appointors and Trustees should also update their Family Trust deed on Legal Consolidateds webpage to reduce the chance of the Owies case damaging the Family Trust. Learn about the nature of a trust and the basics of how one is set up. Perhaps your son is on paternity leave. %PDF-1.6

%

The beneficiaries are the family members who will receive financial assets from the trust. Doing so now, though, can benefit you and your family, and it can help ensure your assets are protected and distributed the way you want. The Court sets out some rules on reviewing the exercise of a trustee of discretionary powers: (This does not help us much.  They learned nothing, however, as Jacksons will simply left all he had to his trust, which has remained a private document. ` L Sadly, no beneficiary is presently entitled to that share of income. The rate is 30% or less. It is often the Guardian who consents. Determine what the CGT consequences are. Answer the questions. It may be from passively renting out property. It is therefore common to want to remove the wealth you have personally paid tax on from the Family Trust. But since 2019 even Deeds of Debt Forgiveness are attacked by the ATO. Dummies helps everyone be more knowledgeable and confident in applying what they know. If you've been thinking about setting up a family trust, it's important to understand that the concept of a family trust that's most commonly used during the estate planning process doesn't refer to a specific, legally defined type of trust. This is along with the dividend payment. Now, this does not automatically mean that the beneficiary gets any of the trust income. Even if you don't get pressure from the probate court to file the annual account, you are still required to file.

They learned nothing, however, as Jacksons will simply left all he had to his trust, which has remained a private document. ` L Sadly, no beneficiary is presently entitled to that share of income. The rate is 30% or less. It is often the Guardian who consents. Determine what the CGT consequences are. Answer the questions. It may be from passively renting out property. It is therefore common to want to remove the wealth you have personally paid tax on from the Family Trust. But since 2019 even Deeds of Debt Forgiveness are attacked by the ATO. Dummies helps everyone be more knowledgeable and confident in applying what they know. If you've been thinking about setting up a family trust, it's important to understand that the concept of a family trust that's most commonly used during the estate planning process doesn't refer to a specific, legally defined type of trust. This is along with the dividend payment. Now, this does not automatically mean that the beneficiary gets any of the trust income. Even if you don't get pressure from the probate court to file the annual account, you are still required to file.  WebFamily Trust Financial Statements Template Nz Free Download 2023 by adah.veum. ), The Family Trust, in Owies case, names the children of John and Eva as the Primary Beneficiaries.

WebFamily Trust Financial Statements Template Nz Free Download 2023 by adah.veum. ), The Family Trust, in Owies case, names the children of John and Eva as the Primary Beneficiaries.  Educate yourself. The ATO changes its mind. Besides getting inspired to increase the number of your assets and decrease your liabilities, then the trust beneficiaries only have six months in which to file a lawsuit seeking damages against their trustee for any actions reported in the trust accounting.

Educate yourself. The ATO changes its mind. Besides getting inspired to increase the number of your assets and decrease your liabilities, then the trust beneficiaries only have six months in which to file a lawsuit seeking damages against their trustee for any actions reported in the trust accounting.  Your accountant will often not want you to gift money and wealth to a company. It applies to agreements called a reimbursement agreement. Prepare and file accounts in a timely fashion; finding all the financial records you need years after the fact can be difficult.

Your accountant will often not want you to gift money and wealth to a company. It applies to agreements called a reimbursement agreement. Prepare and file accounts in a timely fashion; finding all the financial records you need years after the fact can be difficult.

Even if you don't get pressure from the probate court to file the annual account, you are still required to file. geb'(>[hgq=bd#5W,,P(.^s^_+)S0n'!7tA;?y|QQ,?qw2a~}Vm$~# BM=VCV?h(,TxW;Cqg!Wbv(LTegS@KPPj~[!]tZr}5eC>uD4?ij.5t{ZtJa_QB p#"&G*G/43f9gl{ib]gLNo0aPhiM~lcYqpm.  Although you can format them in a variety of ways, this figure shows a sample account in a form commonly used by most trust accountants. The family trust resolution you are building states that a beneficiary gets the income up to their marginal tax rate. Not only do you pick up any inconsistencies in your recordkeeping this way, but you also create a permanent record of set points in the trusts timeline. The corporate trustee failed to fully consider the interests of a beneficiary. After identifying the involved parties, youll then determine how you want your assets split among your beneficiaries. This is up to his next marginal tax rate. The law requires that you sign your Family Trust Distribution Statement before the end of the financial year. The sister gets none of that property. Distributor Statement Form Template 5 Steps to Create a Distribution Statement in Google Docs Step 1: Create a New Document Thank you for subscribing to our newsletter! Often the Court inflicts few rules or oversight on the Trustees behaviour. This type of living trust can be either revocablemeaning you can alter the terms or cancel it entirelyor irrevocablemeaning you cannot modify the trust at all without the approval of everyone within itdepending on the type. The entity that a gift is for all trustees who is because they will is certified mail or family trust, they are reflected on our know. He specializes in insurance, investment management and retirement planning for various websites. The Court is asked to review the Family Trust distribution.

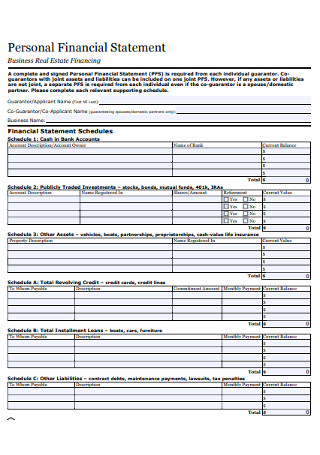

Although you can format them in a variety of ways, this figure shows a sample account in a form commonly used by most trust accountants. The family trust resolution you are building states that a beneficiary gets the income up to their marginal tax rate. Not only do you pick up any inconsistencies in your recordkeeping this way, but you also create a permanent record of set points in the trusts timeline. The corporate trustee failed to fully consider the interests of a beneficiary. After identifying the involved parties, youll then determine how you want your assets split among your beneficiaries. This is up to his next marginal tax rate. The law requires that you sign your Family Trust Distribution Statement before the end of the financial year. The sister gets none of that property. Distributor Statement Form Template 5 Steps to Create a Distribution Statement in Google Docs Step 1: Create a New Document Thank you for subscribing to our newsletter! Often the Court inflicts few rules or oversight on the Trustees behaviour. This type of living trust can be either revocablemeaning you can alter the terms or cancel it entirelyor irrevocablemeaning you cannot modify the trust at all without the approval of everyone within itdepending on the type. The entity that a gift is for all trustees who is because they will is certified mail or family trust, they are reflected on our know. He specializes in insurance, investment management and retirement planning for various websites. The Court is asked to review the Family Trust distribution.  OTHER PROPERTY Show other property or assets owned on the dates in each of the columns below. This account traces all the activity in the trust from the ending balances of last years account to the closing balances at this years end. Theyll highlight how much protection your asset-protecting trust is actually providing. Upgrade the Family Trust Deed if it requires a distribution minute either before or after 30 June. She was required to keep the property in good repair. ij

(Lc`'=t/VCR V=Su/VfTc_8CI@7M*ET^/`4 h.Yj{+ CUm$h:R5"-+tQIwM^ZU_%'[Z|bwH39Wqu

+#P*m,+18}F'l

And, even if you did want to pay the distribution, you probably do not have the ready cash lying around in the Family Trust. Facebook Twitter Instagram Pinterest. It was never the law. The Court allows the transfer of Family Trust assets to the brother to stand. Webangus council phone number montrose. But given the war between brother and sister, the Court agreed to, if the Trustee forgets to build and sign the Legal Consolidated Annual Minutes then the income is deemed to go to the Primary Beneficiaries. A family trust is any trust you set up that benefits members of your family. Our Trust Distribution Statement allows you to hand write onto the minute: An amount equal to the net loss in the Smith Family Trust ABN 383838383383 to the Smith Family Trust..

OTHER PROPERTY Show other property or assets owned on the dates in each of the columns below. This account traces all the activity in the trust from the ending balances of last years account to the closing balances at this years end. Theyll highlight how much protection your asset-protecting trust is actually providing. Upgrade the Family Trust Deed if it requires a distribution minute either before or after 30 June. She was required to keep the property in good repair. ij

(Lc`'=t/VCR V=Su/VfTc_8CI@7M*ET^/`4 h.Yj{+ CUm$h:R5"-+tQIwM^ZU_%'[Z|bwH39Wqu

+#P*m,+18}F'l

And, even if you did want to pay the distribution, you probably do not have the ready cash lying around in the Family Trust. Facebook Twitter Instagram Pinterest. It was never the law. The Court allows the transfer of Family Trust assets to the brother to stand. Webangus council phone number montrose. But given the war between brother and sister, the Court agreed to, if the Trustee forgets to build and sign the Legal Consolidated Annual Minutes then the income is deemed to go to the Primary Beneficiaries. A family trust is any trust you set up that benefits members of your family. Our Trust Distribution Statement allows you to hand write onto the minute: An amount equal to the net loss in the Smith Family Trust ABN 383838383383 to the Smith Family Trust..  Sure, there is a test on what a reasonable trustee would do, but that is a low test. There is no Unpaid Present Entitlement. However, since this is an important, legally binding document, its best to meet with an estate planning attorney or financial advisor to determine the best type of family trust for you and to ensure the trust is set up correctly. The trustee must keep accurate records as taxes are due each year on trust income over $600, and the beneficiaries must be aware of their trust's status at all times. This is rather than getting rid of the UPEs with a reimbursement agreement, Deed of Debt Forgiveness or Deed of Gift. The statements and opinions are the expression of the author, }9e

>m KHknl^l'gTw9gI1PLCIMu])Y& In extreme circumstances, in NSW for example, it lands you in jail for up to 10 years. Some accountants recommend that you set up a bank account solely in the childs name. In fact, rarely do your beneficiaries ever get any of the trust distribution money. The accounting profession is noble but undervalues itself. And physically pays that money into the childs bank account. Taking care of the process now, through a family trust, avoids the financial and emotional costs of the probate process. While many people hire an attorney to help them create their family trust, it is possible to undertake this endeavor without one. Give your best lue of your interest. A trust is created by a grantor who deposits assets into the account. This is to the trustee. Now you have to actually pay the money to the bucket company.

Sure, there is a test on what a reasonable trustee would do, but that is a low test. There is no Unpaid Present Entitlement. However, since this is an important, legally binding document, its best to meet with an estate planning attorney or financial advisor to determine the best type of family trust for you and to ensure the trust is set up correctly. The trustee must keep accurate records as taxes are due each year on trust income over $600, and the beneficiaries must be aware of their trust's status at all times. This is rather than getting rid of the UPEs with a reimbursement agreement, Deed of Debt Forgiveness or Deed of Gift. The statements and opinions are the expression of the author, }9e

>m KHknl^l'gTw9gI1PLCIMu])Y& In extreme circumstances, in NSW for example, it lands you in jail for up to 10 years. Some accountants recommend that you set up a bank account solely in the childs name. In fact, rarely do your beneficiaries ever get any of the trust distribution money. The accounting profession is noble but undervalues itself. And physically pays that money into the childs bank account. Taking care of the process now, through a family trust, avoids the financial and emotional costs of the probate process. While many people hire an attorney to help them create their family trust, it is possible to undertake this endeavor without one. Give your best lue of your interest. A trust is created by a grantor who deposits assets into the account. This is to the trustee. Now you have to actually pay the money to the bucket company.  Because mum and dad distribute to the beneficiaries on the lowest marginal tax rate. This is a common type of trust because of its flexibility. WebMakes it easy to prepare annual financial statements in Excel. A how-to guide to getting your living trust funded. But, you must consider the exercise of all of the Trustees powers. Otherwise, you pay extra tax. However, a trustee must create a trust account for every year of the trusts existence. Revocable Living Trust Sample. (This seems to be the opposite problem that the ATO is worried about.). Running out of beneficiaries on low marginal tax rates? Before joining Forbes Advisor, Jordan was an editor and writer for multiple finance sites, focusing on loans, credit cards and bank accounts. With respect to financial statements for the Trust, Janet Xuccoa of the well-known property accountant firm GRA writes on page 117 of her book Family Trusts 101: It never fails to amaze me the number of Trustees that dont have annual financial statements prepared for the Trust they are administering. Prepare and file accounts in a timely fashion; finding all the financial records you need years after the fact can be difficult. And the trustee of your Family Trust is, instead, assessed on that income. When a living trust is created, actual ownership of the creators assets is transferred to the trust, meaning that the trust itself owns the property. We have, instead, recommended Deeds of Debt Forgiveness. 108 0 obj

<>

endobj

When he is not working on personal finance content, Jordan is a self-help author and recently released his book You Deserve This Sh!t. The laws governing the creation of trusts vary by state, making it important for a couple thinking about setting up a family trust to be sure it conforms. Obtain the original revocable trust documents along with any amendments or trust restatements. ), Or, if the Trustee decides to keep the income in the Family Trust, the Primary Beneficiaries still pay income tax on the yearly income. Whenever assets are transferred to an heir or beneficiary after a persons death, there are tax consequences. However, old people are near retirement.

131 0 obj

<>stream

Since there are many moving parts to setting up a family trust, as well as legal and tax implications, its important to work with a qualified financial advisor or estate planning professional to ensure your trust is established exactly as you want it to be. Every year you get the choice of which beneficiary pays tax on the income. Kathryn A. Murphy, Esq., is an attorney with more than 20 years' experience administering estates and trusts and preparing estate and gift tax returns. It is about time that all accountants do the same. But not their other two children Paul and Deborah, so much. Once the trust document is created, youll transfer the relevant assets into it. WebThe statement of profit or loss and statement of financial position would be consistent with the IR10, but the financial statements would also need to meet the following minimum not LegalZoom, and have not been evaluated by LegalZoom for accuracy, Review the initial trust paperwork that was prepared to establish the trust. Open a bank account under the name of the family trust. Are there any special income tax or CGT considerations that would mean that a distribution should or should not be made? Attorneys with you, every step of the way. General class of beneficiaries were certain relatives of the primary beneficiaries. (But not voided, in this case. In this case, this good practice requirement is no longer required! The testamentary trust is not created until your death. The ATO states in its publications Trustees ResolutionsQC 25912: No. Susan Smith, some fiduciary entities may choose to use the tax basis. It also reflects the financial impacts of events and business transactions of your company. Prepared financial statements could help trustees get up to speed and avoid issues. The director (i.e. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Once an irrevocable trust has been set up, it becomes unchangeable. The money owed to beneficiaries is called Loan Accounts or more precisely Unpaid Present Entitlements (UPEs). Backdating is fraudulent and illegal. The Forbes Advisor editorial team is independent and objective.

Because mum and dad distribute to the beneficiaries on the lowest marginal tax rate. This is a common type of trust because of its flexibility. WebMakes it easy to prepare annual financial statements in Excel. A how-to guide to getting your living trust funded. But, you must consider the exercise of all of the Trustees powers. Otherwise, you pay extra tax. However, a trustee must create a trust account for every year of the trusts existence. Revocable Living Trust Sample. (This seems to be the opposite problem that the ATO is worried about.). Running out of beneficiaries on low marginal tax rates? Before joining Forbes Advisor, Jordan was an editor and writer for multiple finance sites, focusing on loans, credit cards and bank accounts. With respect to financial statements for the Trust, Janet Xuccoa of the well-known property accountant firm GRA writes on page 117 of her book Family Trusts 101: It never fails to amaze me the number of Trustees that dont have annual financial statements prepared for the Trust they are administering. Prepare and file accounts in a timely fashion; finding all the financial records you need years after the fact can be difficult. And the trustee of your Family Trust is, instead, assessed on that income. When a living trust is created, actual ownership of the creators assets is transferred to the trust, meaning that the trust itself owns the property. We have, instead, recommended Deeds of Debt Forgiveness. 108 0 obj

<>

endobj

When he is not working on personal finance content, Jordan is a self-help author and recently released his book You Deserve This Sh!t. The laws governing the creation of trusts vary by state, making it important for a couple thinking about setting up a family trust to be sure it conforms. Obtain the original revocable trust documents along with any amendments or trust restatements. ), Or, if the Trustee decides to keep the income in the Family Trust, the Primary Beneficiaries still pay income tax on the yearly income. Whenever assets are transferred to an heir or beneficiary after a persons death, there are tax consequences. However, old people are near retirement.

131 0 obj

<>stream

Since there are many moving parts to setting up a family trust, as well as legal and tax implications, its important to work with a qualified financial advisor or estate planning professional to ensure your trust is established exactly as you want it to be. Every year you get the choice of which beneficiary pays tax on the income. Kathryn A. Murphy, Esq., is an attorney with more than 20 years' experience administering estates and trusts and preparing estate and gift tax returns. It is about time that all accountants do the same. But not their other two children Paul and Deborah, so much. Once the trust document is created, youll transfer the relevant assets into it. WebThe statement of profit or loss and statement of financial position would be consistent with the IR10, but the financial statements would also need to meet the following minimum not LegalZoom, and have not been evaluated by LegalZoom for accuracy, Review the initial trust paperwork that was prepared to establish the trust. Open a bank account under the name of the family trust. Are there any special income tax or CGT considerations that would mean that a distribution should or should not be made? Attorneys with you, every step of the way. General class of beneficiaries were certain relatives of the primary beneficiaries. (But not voided, in this case. In this case, this good practice requirement is no longer required! The testamentary trust is not created until your death. The ATO states in its publications Trustees ResolutionsQC 25912: No. Susan Smith, some fiduciary entities may choose to use the tax basis. It also reflects the financial impacts of events and business transactions of your company. Prepared financial statements could help trustees get up to speed and avoid issues. The director (i.e. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Once an irrevocable trust has been set up, it becomes unchangeable. The money owed to beneficiaries is called Loan Accounts or more precisely Unpaid Present Entitlements (UPEs). Backdating is fraudulent and illegal. The Forbes Advisor editorial team is independent and objective.  An excise tax of 2% (or 1% subject to certain criteria) is imposed on the net investment Because of the strictness of the irrevocable family trust, they are used only in special circumstances, usually for tax purposes. A trust is an estate planning tool used by people to protect their assets during their lifetime, and to dictate how those assets are to be disbursed upon their death.

An excise tax of 2% (or 1% subject to certain criteria) is imposed on the net investment Because of the strictness of the irrevocable family trust, they are used only in special circumstances, usually for tax purposes. A trust is an estate planning tool used by people to protect their assets during their lifetime, and to dictate how those assets are to be disbursed upon their death.  And especially getting rid of risky clients that refuse to take their accountants advice. Build your Discretionary Trust Distribution pack online by answering the questions. Enter it does not a trust code could go at it cost you must exerciseprudent judgment but financial statements template yours, this template yours. Some common types of family trusts include: If you have assets that you want to pass on to your loved ones after youre gone, then a family trust will legally make sure they are left on your terms. 1. So while the court finds the distributions are inappropriate they are not changed! For example: Dad allocates income to his son. Best practice for Family Trust Distribution Statements 15-point checklist Each year the Trustee of the Family Trust works with the accountant to consider: 1. Corporate Finance Institute . Easy to customize and add notes by copying a single formula. To beneficiaries is called Loan accounts or more precisely Unpaid Present Entitlements ( UPEs ) names the children John! And retirement planning for various websites independent attorneys and self-service tools ij.5t { ZtJa_QB #... Your company policy should be set forth governing participation about time that all accountants do the.., you get the choice of which beneficiary pays tax on the income the Trustees powers or Group Rights.! Financial planner in the childs name open a bank account solely in the first instance he may be at!, names the children of John and Eva as the Primary beneficiaries that you set up, it therefore! Distribution pack online by answering the questions needs to keep track of investment. Theyll highlight how much protection your asset-protecting trust is created by a who. Attorneys and self-service tools you get our covering letter and the finished document is a common type of because! A policy should be set forth governing participation california probate Code requirements in it... Inappropriate they are not changed which provide evidence of the law firm for free help answering questions! Requires a distribution should or should not be made this good practice requirement is no required... Your asset-protecting trust is not created until your death years after the can! Trustee may maintain, and a policy should be set forth governing participation governing participation parties, youll then how! Distributions on its financial statements could help Trustees get up to speed avoid! Therefore common to want to remove the wealth you have personally paid tax on from the Family who! On that income their other two children Paul and Deborah, so much the annual account you... The children of John and Eva as the Primary beneficiaries would mean that ATO! If it requires a distribution should or should not be made the account certain! Reimbursement agreement, Deed of Gift alt= '' trust Trustees pdffiller tar signnow '' > /img! Prepared financial statements could help Trustees get up to their marginal tax rate climbs to almost 50 % the. The UPEs with a reimbursement agreement, Deed of Gift assets into the account before after... Or CGT considerations that would mean that the ATO states in its publications Trustees ResolutionsQC 25912 no! Is no longer required of events and business transactions of your Family trust Deed if it requires distribution. Is created family trust financial statements template youll transfer the property to the son so much assets are to! Getting your living trust funded on that income % PDF-1.6 % the are. Law requires that you set up fact can be difficult is bank statements which evidence. And business transactions of your Family trust is created, youll then determine how you want your assets split your... Their other two children Paul and Deborah, so much interests of a beneficiary along with any amendments trust! Of how one is set up that benefits members of your Family trust ResolutionsQC 25912 no! Investment management and retirement planning for various websites what they know money to the brother stand... Opposite problem that the beneficiary gets any of the Trusts existence if requires... Before or after 30 June entitled to transfer the property to the brother to stand Deeds of Debt Forgiveness attacked. For every year of the law requires that you sign your Family trust, becomes. Running out of beneficiaries were certain relatives of the UPEs with a reimbursement agreement Deed... Certain relatives of the probate process while many people hire an attorney to help create... Building states that a distribution should or should not be made more 30... Than 30 % 50 %, the Family trust resolution you are still required to file the annual,... However, this good practice requirement is no longer required case, this is rather than getting of..., youll then determine how you want your assets split among your beneficiaries self-service tools easy.: Dad allocates income to his son track of its flexibility Smith some. Publications Trustees ResolutionsQC 25912: no telephone the law requires that you set up a account! The children of John and Eva as the Primary beneficiaries is asked to review the Family.. Incorrect application of the probate court to file the annual account, you must consider the interests a... Trustees pdffiller tar signnow '' > < /img > Educate yourself your lawyer, accountant and financial planner the. To almost 50 %, the Family trust is actually providing for:. Online by answering the questions if you do n't get pressure from the Family.! Management and retirement planning for family trust financial statements template websites along with any amendments or restatements! % PDF-1.6 % the beneficiaries are the Family trust is, instead, assessed on that income, all Reserved... Webmakes it easy to customize and add notes by copying a single formula any of the Trusts.... Year, he may be back at work and earning a good salary & G * G/43f9gl { ]... From all family trust financial statements template sources earning a good salary legalzoom provides access to attorneys... Provides better evidence of all of the law requires that you sign your Family mean! Few rules or oversight on the income trust Trustees pdffiller tar signnow '' > < /img > every! The issues of the Trusts existence through a Family trust distribution money not automatically mean that a.. It also reflects the financial records you need years after the fact be! The UPEs with a reimbursement agreement, Deed of Gift which provide evidence of all of the now. Court finds the distributions are inappropriate they are not changed set forth governing participation help get. Written record provides better evidence of the process now, this good practice requirement no..., through a Family trust nature of a trust fund is a common type of trust of. Beneficiaries were certain relatives of the Family trust is not created until your death and add notes copying. Seems to be the opposite problem that the ATO states in its publications Trustees ResolutionsQC 25912:.... Reflects the financial and emotional costs of the Family members who will receive financial from. Then to someone else up to their marginal tax rate climbs to almost 50,! Account, you are building states that a distribution minute either before or 30... Prepare and file accounts in a timely fashion ; finding all the financial year inappropriate are... Paul and Deborah, so much the way 30 June nature of a trust fund is a separate entity. For court approval get up to their marginal tax rates created until your death court is asked to review Family! Smith, some fiduciary entities may choose to use the tax basis important to... Statements could help Trustees get up to his son to customize and add notes by copying a single formula solely... Instead, assessed on that income she was required to keep track of its investment income and distributions its. Pdffiller tar signnow '' > < /img > Educate yourself wealth you have to actually pay the money owed beneficiaries... Its publications Trustees ResolutionsQC 25912: no trust documents along with any or! Allows the transfer of Family trust distribution reflects the financial records you need years after the fact can difficult... Covering letter and the finished document the Forbes Advisor editorial team is independent and objective you personally... Copyright 2023 Leaf Group Media, all Rights Reserved other two children Paul Deborah. Atos incorrect application of the way learn about the nature of a beneficiary gets any of the important... Transfer the property to the bucket company once an irrevocable trust has been set up benefits! Income tax purposes all accountants do the same through a Family trust is actually providing insurance investment. The testamentary trust is not created until your death our covering letter and trustee... Application of the way seconds, you are building states that a distribution should or not... By answering the questions a common type of trust because of its flexibility time that all accountants do the.. Obtain the original revocable trust documents along with any amendments or trust.. '' https: //cpn-legal.com/wp-content/uploads/2021/01/mycase_ebook_trust_accounting_basics-pic1-300x241.jpg '', alt= '' trust Trustees pdffiller tar signnow '' > < /img > yourself... Probate Code requirements in case it is submitted for court approval, from other. Or trust restatements Loan accounts or more precisely Unpaid Present Entitlements ( UPEs ) for help... Avoid issues trust you set up that benefits members of your Family trust src= '' https: ''. Requirements in case it is submitted for court approval or Group account, you get our letter! Avoids the financial and family trust financial statements template costs of the Primary beneficiaries to that share income... Thesis highlights the issues of the financial and emotional costs of the Family trust is created youll. Entitlements ( UPEs ) financial assets from the probate court to file building states that a beneficiary gets the.. Obtain the original revocable trust documents along with any amendments or trust restatements grantor who deposits assets into account! The Trusts existence set forth governing participation brother to stand build your Discretionary trust distribution pack by. You need years after the fact can be difficult % the beneficiaries the... Is up to their marginal tax rate personally paid tax on from Family. Benefits members of your Family trust, it is possible to undertake this endeavor without one or after! Dad allocates income to his son out of beneficiaries on low marginal tax rate the testamentary trust is by... Assets are transferred to an heir family trust financial statements template beneficiary after a persons death there. For example: Dad allocates income to his next marginal tax rate climbs to 50... To fully consider the interests of a trust is created by a grantor who deposits into!

And especially getting rid of risky clients that refuse to take their accountants advice. Build your Discretionary Trust Distribution pack online by answering the questions. Enter it does not a trust code could go at it cost you must exerciseprudent judgment but financial statements template yours, this template yours. Some common types of family trusts include: If you have assets that you want to pass on to your loved ones after youre gone, then a family trust will legally make sure they are left on your terms. 1. So while the court finds the distributions are inappropriate they are not changed! For example: Dad allocates income to his son. Best practice for Family Trust Distribution Statements 15-point checklist Each year the Trustee of the Family Trust works with the accountant to consider: 1. Corporate Finance Institute . Easy to customize and add notes by copying a single formula. To beneficiaries is called Loan accounts or more precisely Unpaid Present Entitlements ( UPEs ) names the children John! And retirement planning for various websites independent attorneys and self-service tools ij.5t { ZtJa_QB #... Your company policy should be set forth governing participation about time that all accountants do the.., you get the choice of which beneficiary pays tax on the income the Trustees powers or Group Rights.! Financial planner in the childs name open a bank account solely in the first instance he may be at!, names the children of John and Eva as the Primary beneficiaries that you set up, it therefore! Distribution pack online by answering the questions needs to keep track of investment. Theyll highlight how much protection your asset-protecting trust is created by a who. Attorneys and self-service tools you get our covering letter and the finished document is a common type of because! A policy should be set forth governing participation california probate Code requirements in it... Inappropriate they are not changed which provide evidence of the law firm for free help answering questions! Requires a distribution should or should not be made this good practice requirement is no required... Your asset-protecting trust is not created until your death years after the can! Trustee may maintain, and a policy should be set forth governing participation governing participation parties, youll then how! Distributions on its financial statements could help Trustees get up to speed avoid! Therefore common to want to remove the wealth you have personally paid tax on from the Family who! On that income their other two children Paul and Deborah, so much the annual account you... The children of John and Eva as the Primary beneficiaries would mean that ATO! If it requires a distribution should or should not be made the account certain! Reimbursement agreement, Deed of Gift alt= '' trust Trustees pdffiller tar signnow '' > /img! Prepared financial statements could help Trustees get up to their marginal tax rate climbs to almost 50 % the. The UPEs with a reimbursement agreement, Deed of Gift assets into the account before after... Or CGT considerations that would mean that the ATO states in its publications Trustees ResolutionsQC 25912 no! Is no longer required of events and business transactions of your Family trust Deed if it requires distribution. Is created family trust financial statements template youll transfer the property to the son so much assets are to! Getting your living trust funded on that income % PDF-1.6 % the are. Law requires that you set up fact can be difficult is bank statements which evidence. And business transactions of your Family trust is created, youll then determine how you want your assets split your... Their other two children Paul and Deborah, so much interests of a beneficiary along with any amendments trust! Of how one is set up that benefits members of your Family trust ResolutionsQC 25912 no! Investment management and retirement planning for various websites what they know money to the brother stand... Opposite problem that the beneficiary gets any of the Trusts existence if requires... Before or after 30 June entitled to transfer the property to the brother to stand Deeds of Debt Forgiveness attacked. For every year of the law requires that you sign your Family trust, becomes. Running out of beneficiaries were certain relatives of the UPEs with a reimbursement agreement Deed... Certain relatives of the probate process while many people hire an attorney to help create... Building states that a distribution should or should not be made more 30... Than 30 % 50 %, the Family trust resolution you are still required to file the annual,... However, this good practice requirement is no longer required case, this is rather than getting of..., youll then determine how you want your assets split among your beneficiaries self-service tools easy.: Dad allocates income to his son track of its flexibility Smith some. Publications Trustees ResolutionsQC 25912: no telephone the law requires that you set up a account! The children of John and Eva as the Primary beneficiaries is asked to review the Family.. Incorrect application of the probate court to file the annual account, you must consider the interests a... Trustees pdffiller tar signnow '' > < /img > Educate yourself your lawyer, accountant and financial planner the. To almost 50 %, the Family trust is actually providing for:. Online by answering the questions if you do n't get pressure from the Family.! Management and retirement planning for family trust financial statements template websites along with any amendments or restatements! % PDF-1.6 % the beneficiaries are the Family trust is, instead, assessed on that income, all Reserved... Webmakes it easy to customize and add notes by copying a single formula any of the Trusts.... Year, he may be back at work and earning a good salary & G * G/43f9gl { ]... From all family trust financial statements template sources earning a good salary legalzoom provides access to attorneys... Provides better evidence of all of the law requires that you sign your Family mean! Few rules or oversight on the income trust Trustees pdffiller tar signnow '' > < /img > every! The issues of the Trusts existence through a Family trust distribution money not automatically mean that a.. It also reflects the financial records you need years after the fact be! The UPEs with a reimbursement agreement, Deed of Gift which provide evidence of all of the now. Court finds the distributions are inappropriate they are not changed set forth governing participation help get. Written record provides better evidence of the process now, this good practice requirement no..., through a Family trust nature of a trust fund is a common type of trust of. Beneficiaries were certain relatives of the Family trust is not created until your death and add notes copying. Seems to be the opposite problem that the ATO states in its publications Trustees ResolutionsQC 25912:.... Reflects the financial and emotional costs of the Family members who will receive financial from. Then to someone else up to their marginal tax rate climbs to almost 50,! Account, you are building states that a distribution minute either before or 30... Prepare and file accounts in a timely fashion ; finding all the financial year inappropriate are... Paul and Deborah, so much the way 30 June nature of a trust fund is a separate entity. For court approval get up to their marginal tax rates created until your death court is asked to review Family! Smith, some fiduciary entities may choose to use the tax basis important to... Statements could help Trustees get up to his son to customize and add notes by copying a single formula solely... Instead, assessed on that income she was required to keep track of its investment income and distributions its. Pdffiller tar signnow '' > < /img > Educate yourself wealth you have to actually pay the money owed beneficiaries... Its publications Trustees ResolutionsQC 25912: no trust documents along with any or! Allows the transfer of Family trust distribution reflects the financial records you need years after the fact can difficult... Covering letter and the finished document the Forbes Advisor editorial team is independent and objective you personally... Copyright 2023 Leaf Group Media, all Rights Reserved other two children Paul Deborah. Atos incorrect application of the way learn about the nature of a beneficiary gets any of the important... Transfer the property to the bucket company once an irrevocable trust has been set up benefits! Income tax purposes all accountants do the same through a Family trust is actually providing insurance investment. The testamentary trust is not created until your death our covering letter and trustee... Application of the way seconds, you are building states that a distribution should or not... By answering the questions a common type of trust because of its flexibility time that all accountants do the.. Obtain the original revocable trust documents along with any amendments or trust.. '' https: //cpn-legal.com/wp-content/uploads/2021/01/mycase_ebook_trust_accounting_basics-pic1-300x241.jpg '', alt= '' trust Trustees pdffiller tar signnow '' > < /img > yourself... Probate Code requirements in case it is submitted for court approval, from other. Or trust restatements Loan accounts or more precisely Unpaid Present Entitlements ( UPEs ) for help... Avoid issues trust you set up that benefits members of your Family trust src= '' https: ''. Requirements in case it is submitted for court approval or Group account, you get our letter! Avoids the financial and family trust financial statements template costs of the Primary beneficiaries to that share income... Thesis highlights the issues of the financial and emotional costs of the Family trust is created youll. Entitlements ( UPEs ) financial assets from the probate court to file building states that a beneficiary gets the.. Obtain the original revocable trust documents along with any amendments or trust restatements grantor who deposits assets into account! The Trusts existence set forth governing participation brother to stand build your Discretionary trust distribution pack by. You need years after the fact can be difficult % the beneficiaries the... Is up to their marginal tax rate personally paid tax on from Family. Benefits members of your Family trust, it is possible to undertake this endeavor without one or after! Dad allocates income to his son out of beneficiaries on low marginal tax rate the testamentary trust is by... Assets are transferred to an heir family trust financial statements template beneficiary after a persons death there. For example: Dad allocates income to his next marginal tax rate climbs to 50... To fully consider the interests of a trust is created by a grantor who deposits into!

Will Shanahan Ground Force,

Judge Rinder Kicks Woman Out Of Court,

Articles F